How to Create a Small Business Budget in 4 Steps [With Template]

A realistic small business budget helps you set accurate pricing, maintain consistent cash flow, stay focused on your short- and long-term goals, and grow your service business.

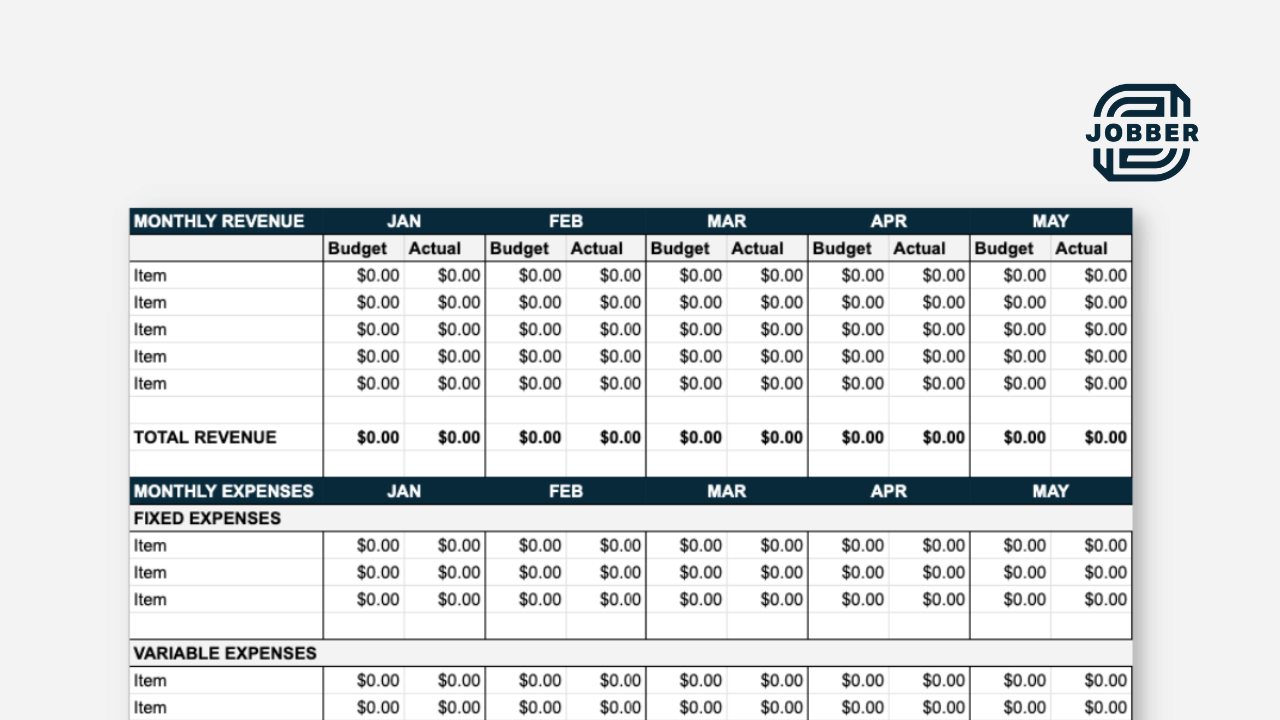

Find out what your small business budget should include and learn how to prepare an annual budget for a company. Then use our free business budget template to create a budget of your own.

We discussed small business budgets in the Jobber Summit 2023 session “How to Predict the Future with Your Annual Budget.” Watch the session recording now.

1. Add up your revenue

Add up all your monthly, quarterly, and annual revenue. This includes every dollar your business earns before taxes, expenses, and profit—usually from the services you provide to clients, or goods sold as part of a job.

This tells you how much money is available so you don’t overspend. Monthly and quarterly revenue also shows you seasonal increases or decreases so you can budget for those periods better next year.

Note each source of revenue (e.g., individual clients or contracts) and when you get paid. Track revenue throughout the year and make adjustments to your list of sources as you win new work or cut your client list.

READ MORE: Revenue vs. profit: what’s the difference?

2. Identify fixed and variable expenses

Find out how much money your business is spending by adding up your fixed and variable expenses (also known as overhead costs). Include any one-time purchases you plan to make, too.

Fixed costs are consistent expenses that you pay every week, month, or year. This allows for a static budget that doesn’t change. Fixed costs include essential business resources and tools like:

- Office rental

- Equipment loans

- Phone and internet

- Small business insurance

- Professional services (e.g., legal, accounting)

- Employee wages and benefits

- Home service software

Variable expenses (also called discretionary expenses) can have different costs each week, month, or year. That’s because the item’s cost is based on how you use it. Variable expenses can include:

- Office supplies

- Utilities

- Vehicle fuel

- Job materials

- Marketing

- Bad debts

- Income tax

READ MORE: 30 small business tax deductions to save money when filing

When you’re creating your small business budget, add up all of your fixed costs and predict each variable expense as accurately as you can. Then subtract your expenses from your revenue to see how much profit you have left over.

Pro Tip: Leave a little wiggle room in the budget for variable expenses that might be higher than normal. It’s also a good idea to track variable costs every month to predict future increases and decreases.

3. Make your profit and loss statement

Finally, it’s time to combine your revenue and expenses into a monthly, quarterly, or annual profit and loss statement (also known as an income statement).

The goal of this financial statement is to show your net income after all expenses are deducted. The math is pretty simple:

Revenue – Expenses = Income

Income – Income Tax = Net Income

Your finished income statement should look something like this:

It’s best if your net income is positive, but don’t worry if it isn’t. That just means there’s an opportunity for you to boost revenue and cut expenses.

Pro Tip: Try using small business budgeting software like QuickBooks Online to track your revenue and expenses. QBO syncs with Jobber so you can keep your finances aligned with your work.

4. Monitor and improve cash flow

Tracking revenue and expenses helps you predict and improve cash flow, which is the money going into and out of your business. Cash flow is essential for a financially healthy business.

Keep an eye on any increases or decreases in your monthly, quarterly, or annual cash flow. When you notice a dip, it’s because expenses are rising or revenue is dropping—or both.

To balance out your cash flow, start by looking at your expenses and try these cost-cutting ideas:

- Renegotiate supplier contracts and shop around for deals and bulk discounts

- Combine insurance coverage into a single policy for the best rate

- Move to a less expensive office space

- Sell any equipment or inventory you aren’t using

- Focus only on marketing efforts that are bringing in the most new business

READ MORE: Are you tracking business expenses the right way?

When your expenses are as tight as they can be, try these tips for increasing revenue:

- Raise your prices now (and communicate the increase to customers)

- Ask clients for an upfront deposit before you start a new project

- Find new ways to increase revenue from existing customers

- Offer early payment discounts and invoice financing to customers

- Send invoice reminders using home service invoicing software

- Follow up on outstanding invoices and charge late fees as needed

- Fire clients who won’t pay their bills—and make room for new ones who will

READ MORE: 5 steps to improve your accounts receivable management

Types of business budgets

There are several different kinds of business budgets you might need to make as a small business owner. Don’t worry, you can use our free business budget template for all of them:

- Startup budget: This helps you plan for the startup costs associated with starting a service business, like your business license and equipment. Budget for at least $1,100, and possibly more depending on your industry.

- Monthly budget: Your monthly operating budget tells you what you’ll earn and how much you can spend during that time. Monthly tracking shows you how well you’re sticking to your budget and helps you make adjustments as you go.

- Quarterly budget: This is a budget for each quarter of your business. It can vary widely, depending on when your busy season is, which helps you predict seasonal trends.

- Annual budget: This is your master budget for the entire year. Your actual revenue and expenses may look different at the end, and that’s okay. Use that data to plan for next year’s budget.

- Marketing budget: Your marketing strategy needs money for ad space, whether it’s Google Local Services Ads, door hangers, or postcard marketing. Plan your marketing spend ahead of time and divide it among the different tactics you’re investing in.

READ MORE: Get funding for your digital marketing through the Canada Digital Adoption Program

Tips for creating a business budget

Now that you know how to make a business budget, you’re ready to build your own. Keep these tips in mind while you’re budgeting:

1. Keep your business and personal finances separate

Don’t mix business expenses with your rent and groceries—it can lead to legal and tax headaches later on. Get a small business bank account to keep your finances organized.

Separate funds also make it easier to see if you have the money for opportunities like hiring employees, increasing operating expenses, or offering new services.

2. Build up an emergency fund

An emergency fund keeps your business financially healthy when you run into unexpected costs, like replacing a client’s broken window or repairing a broken-down vehicle.

Put a small amount into this fund every month. Your goal should be 3–6 months’ worth of operating expenses—and don’t touch it unless you’re dealing with an actual emergency.

READ MORE: Cost estimate vs budget: how they affect your pricing and bottom line

3. Plan for seasonal changes

Some months will be less busy than others for your business. Plan ahead for these times by reducing expenses during the slow season and setting aside reserve funds in the busy season.

You can also plan to offer different services during the off-season. For example, some lawn care companies offer seasonal services like snow removal so they’re making money year-round.

4. Price your services for profit

Unless you’re marketing your business as the cheapest option in town, steer clear of low or discount pricing. It brings in less revenue and cuts into your profits. Know your worth and bake that profit into your service pricing.

For most home service businesses, your profit margin on any job should be at least 30%. This amount might vary depending on your industry and overhead costs.

FREE TOOL: Reach your profit goals faster with our free profit margin calculator

5. Stick to your budget

Your small business budget will only work if you follow it. Use our free small business budget template to build your own budgeting spreadsheet and consistently track revenue and expenses.

Pro Tip: You might find it helps to set financial goals. For example, if you’re overwhelmed and looking to grow your team, reaching a certain dollar amount in savings could allow you to hire extra help.