Job Costing: The Key to Profitability for Service Businesses

Job costing is a way of calculating the actual cost and revenue associated with specific jobs or services you provide. It takes into account direct labor, material, and expenses on each job so that you can better understand your true costs and get better at pricing for profit.

With the right job costing system, you can complete more jobs within the estimated cost budget, set more profitable future prices, and make better financial decisions for your business.

What is job costing and why should you use it?

Job costing is a cost accounting method that involves tracking all the costs directly associated with a specific job, project, or service, in order to calculate the total direct cost.

Service businesses use it to determine the profitability of individual jobs, manage project costs, and estimate the cost of new projects more accurately.

Job costing takes direct labor, material, and expenses into account on every job so you can easily understand why certain jobs are less profitable than others and take the guesswork out of your bottom line.

Job costing vs service pricing

Service pricing is how you set the prices for the upcoming jobs. To determine a price, you’ll usually take into account expected labor, expected material, and your desired profit amount.

Job costing, on the other hand, looks at the final revenue and final costs of completed jobs. Those costs include everything from direct material and labor to miscellaneous expenses, like extra PPE, that can crop up and throw your budget way off.

Another term you may hear is job costing vs process costing. The main difference between job costing and process costing is that process costing is used in mass production to assign manufacturing costs to units produced. It is not used in service-based businesses.

Who uses job costing?

Job costing is useful for any business that wants to understand the true cost of their services and price jobs for profit.

In particular, service businesses with lots of variable labor and material costs between jobs, such as construction, contracting, HVAC, landscaping, and tree care, can benefit from job costing.

Since each service can differ from the next, job costing helps these businesses set better future prices by providing insights into the actual costs incurred for each type of job.

How to calculate total job cost (job costing formula)

The total job cost is calculated by adding up all of the expenses related to a specific job, and comparing them to the revenue generated from that job to see if it was profitable.

The formula for job costing is:

Total Job Cost = Direct Materials and Expenses + Direct Labor Costs + Estimated Overhead

To break it down further, here are the factors that go into the formula:

Step 1: Calculate your labor costs

Direct labor refers to the wages or salaries of the employees who worked directly on that particular job.

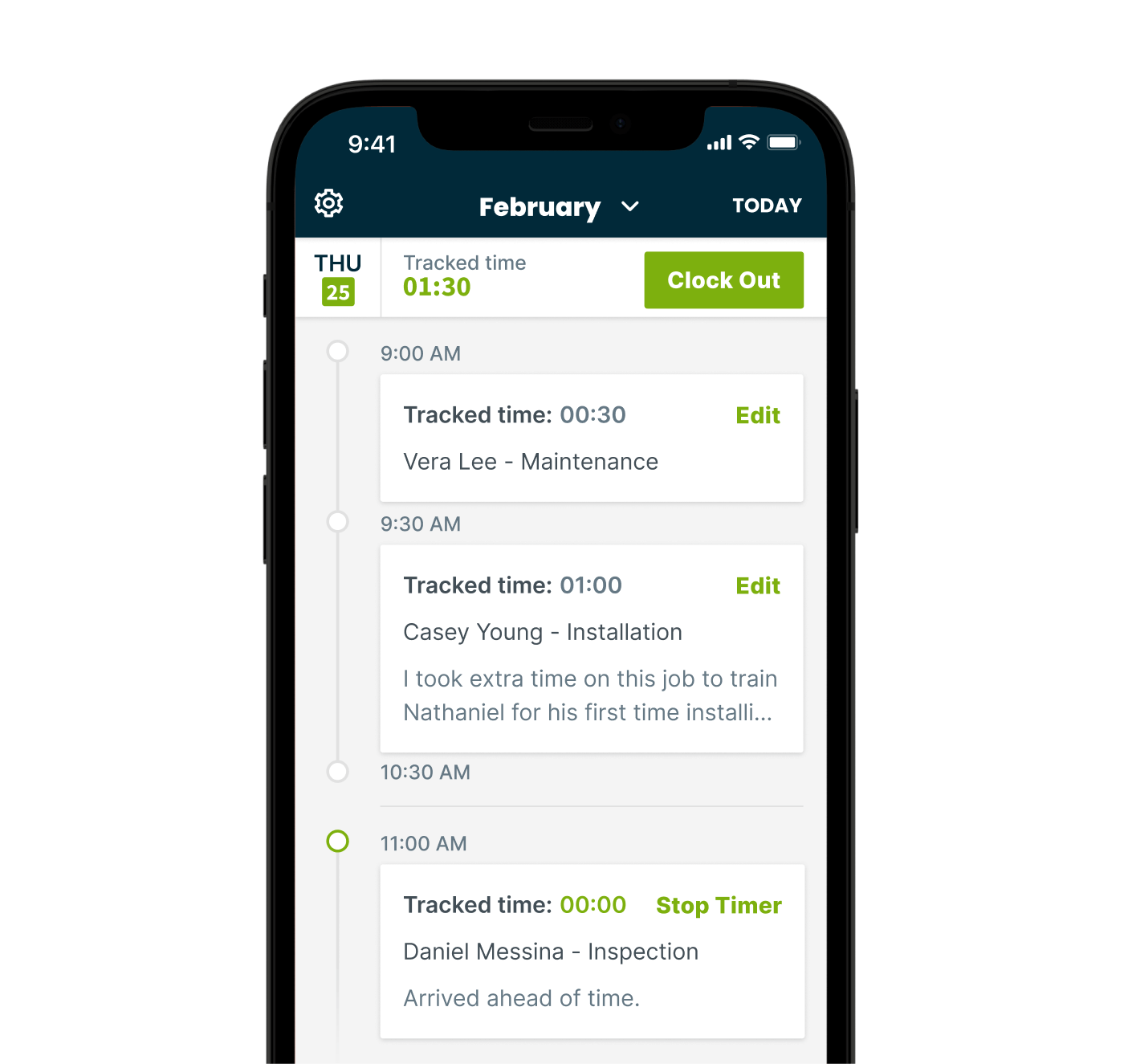

To calculate direct labor cost, you need to know the number of labor hours each employee worked on the job and their respective wage rates. If you use timesheet software, you’ll find the hourly cost of your employees and their time worked on the job there.

If not, multiply the number of hours worked by the wage rate for each employee, and then sum up these individual costs to get the total direct labor cost.

Here’s the calculation :

Direct Labor Cost = (Number of Hours Worked by Employee 1 x Wage Rate of Employee 1) + (Number of Hours Worked by Employee 2 x Wage Rate of Employee 2) + …

For example, let’s say you have two employees who worked on a job. Employee 1 worked 10 hours at an hourly wage rate of $20, and Employee 2 worked 8 hours at an hourly wage rate of $18. The calculation would be:

(10 hours x $20) + (8 hours x $18) = $200 + $144 = $344

The direct labor cost for that particular job would be $344.

Step 2: Add up material costs and expenses

Your material cost includes:

- The direct materials used to complete the job, such as lumber, drywall, and insulation

- Additional expenses, such as equipment that you purchased to complete this specific job, or unexpected expenses that came up while completing it – think PPE, cleaning supplies, fuel, or extra wiring.

If you use job management software like Jobber, you can add up the line item costs and expenses you’ve tracked to quickly calculate your material costs.

Step 3: Estimate your overhead costs

Finally, add up the indirect costs of the job, also known as overhead costs. Overhead includes costs such as rent, utilities, office supplies, indirect labor like admin staff, and equipment upkeep. These types of expense aren’t directly attributed to any particular job, but are required to keep your business running.

When it comes to job costing, overhead can be a little tricky to calculate. For example, if you have a lease on your work truck, you’ll have to approximate how much of that indirect cost to attribute to each job.

One way to do this is by figuring out your hourly overhead rate. The formula is:

Hourly Overhead Rate = Total Monthly Overhead Costs ÷ # of Billable Hours Per Month

In small business accounting, a common way to do this is to calculate your total business overhead and then apply a standard overhead fee to each project, such as 10 or 20% per job.

Step 4: Calculate the total cost per job

Add up the total amounts for your direct labor cost, material costs, and estimated overhead cost.

This is the total cost of the job in question.

Step 5: Determine your profitability

To determine if the job was profitable, take your total revenue and subtract the total cost. The formula is:

Profit = Revenue – Total costs

If your profit is positive, you’ve got a winning pricing strategy.

If your profit is negative, it’s time to increase your prices.

Job costing examples for service businesses

1. Example of contractor job costing to determine profitability

A handyman contractor wants to calculate the cost of painting and installing a door to determine if this is a service they’ve priced profitably or if they should increase their prices.

The price they quoted the client was $500.

The handyman starts by looking at their labor costs. In this case, one contractor and one subcontractor performed the service. The contractor’s timesheet showed they worked 6 hours at a wage of $24 per hour, while the subcontractor worked 4 hours for $20 an hour. The total labor cost for this job is $224.

Next, they look at the material costs: one door with hardware, one gallon of paint, 2 paint brushes, and the fuel expenses for each worker to get to the job. In total, this adds up to $150.

Finally, the business owner applies a 10% overhead rate to each job, adding an additional $75.

All in, the total job cost for this job is $449.

Priced at $500, this job brought in $51 in profit. Using our profit margin calculator, that’s a profit of just 10%. While that’s not bad, in future, this job could be priced higher to reach a profit margin of at least 20%.

2. Example of construction job costing to set future prices

Job costing is especially useful for complex services that are difficult to price.

For example, a small construction company could use job costing to determine the exact costs of building a custom home. Using the exact same formula described above, they’ll know how much money they spent, and be able to adjust the price accordingly on their next custom home build to ensure profitability.

The more they use job costing, the better they’ll get at predicting costs, even as they take on new and more complex jobs.

How to get the full benefits of job costing

Job costing might sound like just another formula for your accountant to think about, not you.

But in reality, it can give you a clearer picture of real costs, so you can make better business decisions. Here are the full benefits you can get by tracking your job costs:

1. Accurate cost estimation and cost control: Job costing gives you the ability to accurately estimate the cost of each project. That means no more guesswork when it comes to budgeting.

2. Optimized profits and cash flow: When you know how profitable (or not) each job is, you can set fair, competitive prices that keep you in business longer.

3. Cost and resource efficiency: Job costing allows service businesses to determine how much labor and materials are required for each job. By doing so, businesses can allocate resources efficiently and ensure that they are using their resources effectively.

4. Better business decisions: With accurate business data and reporting, you can make informed decisions that lead to a steady cash flow and a healthier business. Who doesn’t want that?

Save time on admin work with job cost accounting software

Above, we’ve given you the formula for job order costing. But instead of plugging that into a spreadsheet and calculating it manually, you can use job costing software to automate the process.

With job costing software like Jobber, you can pull in line item costs, expenses, and timesheets for each job and see your full job cost, profit amount, and profit margin displayed automatically.

Armed with that data, you can adjust the pricing directly on your future estimates without having to switch between spreadsheets, apps, and handwritten notes.

Start maximizing your profits

Once you’ve wrapped your head around overhead costs, labor hours, and expense tracking, you’ll wonder how you ever priced your services without accurate job costing.

To get even further ahead in your pricing strategy, use our free service price calculator to determine the service price and profit margin on your next job.