Key takeaways:

Improving cash flow is key to growing your service business and positioning it for long-term, positive financial health. Use these tips to stay on top of your financials:

- Track and forecast cash flow regularly. Keep a close eye on income and expenses, use cash flow statements, and forecast for upcoming months to spot trends and make proactive adjustments.

- Streamline invoicing and payment collection. Use professional invoicing templates, set clear payment terms, send invoices immediately, offer online payment options, and automate reminders to get paid faster.

- Control expenses and boost revenue. Cut unnecessary costs, negotiate better rates, and consider equipment leasing, while also exploring ways to raise prices, bundle services, upsell, and generate more leads.

- Build financial resilience. Prepare for seasonal slowdowns by offering recurring services or seasonal packages, maintain a cash reserve, prioritize reliable clients, and ask for deposits to cover upfront costs.

- Leverage technology for cash flow management. Use business management software like Jobber to automate processes, forecast finances, and make data-driven decisions that keep your cash flow positive and support business growth.

For more expert business tips and ways to keep your finances healthy, sign up for the Jobber Newsletter.

Originally published in July 2017. Last updated on November 20, 2025.

Good cash flow management helps you pay bills on time, plan for slow periods, and invest in your business.

Use these tips to learn how to improve cash flow so you can stay on top of costs and strengthen your business’s financial health.

12 tips to increase your business cash flow:

-

Track and forecast cash flow

-

Improve your invoicing process

-

Make it easy for customers to pay you

-

Reduce your expenses

-

Boost your revenue

-

Offer customer financing to win more jobs

-

Ask for deposits

-

Promote recurring services

-

Plan for seasonal fluctuations

-

Build a cash reserve

-

Prioritize reliable clients

-

Use software for better cash flow management

What is cash flow?

Cash flow refers to the money that comes into and goes out of your business bank account. It’s made up of your income, like payments from clients, and bills, such as your overhead costs and operating expenses.

You can have both positive and negative cash flow in a given month.

Positive cash flow is when you cover your bills and still have money left over.

Negative cash flow is when you spend more than you bring in.

Most service businesses experience both, especially if they’re impacted by seasonal demand, like lawn care or snow removal.

Why is managing cash flow important?

Effective cash flow management is important because it directly impacts whether you have the funds needed to cover expenses and keep your business running. Healthy cash inflow helps to ensure you have enough money to:

- Pay your team

- Cover expenses

- Invest in new opportunities

But when cash outflow exceeds inflow, you may have to rely on loans to tide you over, potentially leading to long-term debt and interest charges.

And while 51% of small businesses experience uneven cash flow, your overall goal should be to stay cash flow positive as much as possible. Use these tips for cash flow management so can save for a rainy day, support your business during the off-season, and handle unexpected costs.

1. Track and forecast cash flow

Consistently tracking your cash flow helps you identify trends, predict costs, and plan for big expenses. Over time, you can use it to predict cash flow each week, month, or year to see whether you’re on track to be cash flow positive or if you need to make adjustments to spending.

A simple way to start tracking cash flow is to add up your income and expenses each week. Then, use those numbers to create a cash flow statement you can use to review monthly cash flow.

From there, use your predicted expenses and scheduled jobs to calculate a cash flow budget to predict next month’s cash flow as well. This will help you identify what your cash flow looks like long-term, so you can make adjustments to your expenses and pricing before cash flow issues become a problem.

How to calculate cash flow

To forecast weekly and monthly cash flow, start with this formula:

Cash flow = total cash inflows – total cash outflows

So, let’s say your expenses for the month were $3,500, and your income was $5,000. Your monthly cash flow would be +$1500.

On the other hand, if your expenses were $6,500 and your income was $5,000, your monthly cash flow would be -$1,500.

If you want to go more in-depth and get personalised insights and predictions about your long-term cash flow, you can use a tool like Jobber AI. It can help track, manage, and improve cash flow by giving you:

- Tips to boost conversions over the coming month

- Insights about how quickly your customers pay you after getting an invoice

- Advice on how to use marketing tactics to generate new leads

READ MORE: How to forecast revenue

2. Improve your invoicing process

Getting paid on time and in full directly impacts cash flow. And the more effective your invoicing strategy, the more likely customers are to pay their bills quickly.

To make the most of your invoices, be sure to:

Use a professional invoice template

Invoices that provide clear, detailed information about the services that were provided, the total amount due, and how a client can pay you are the most likely to be paid. Use an invoice template to ensure your invoices are professional, consistent, and easy to understand.

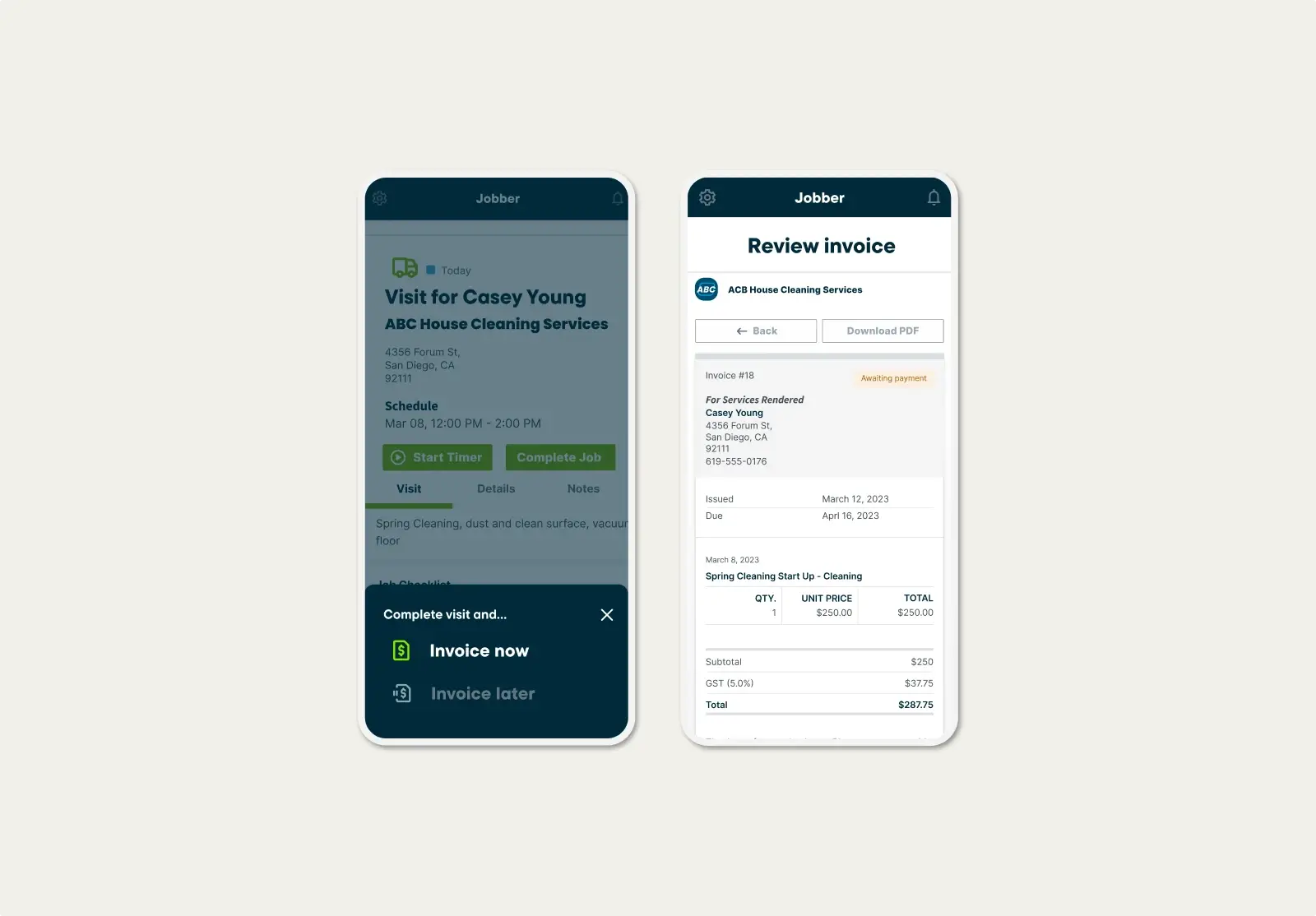

You can also use invoicing software like Jobber to create and send effective invoices in one click, making it easy for clients to pay you.

READ MORE: What to include on an invoice

Set clear payment terms

Payment terms, like when the total amount is due, whether you charge late fees, and how payments can be made, clarify essential information to your clients. Being upfront about when, how, and why clients should pay you to avoid penalties encourages them to pay you faster.

Invoice immediately

When you send an invoice to a client plays a big part in your cash flow. If you invoice clients too late, you may not be paid in time to cover your monthly expenses. Send invoices immediately after a job’s done or within 48 hours to stay top of mind with customers.

Jobber makes it easy to send accurate invoices in just one click. When the job is done, instantly generate a professional digital invoice and send it to your customers by text or email.

Pro Tip: Offer a small early payment discount, like 10%, to encourage timely payments.

Add payment links to your invoices

Payment links make it easy for clients to pay you straight from an invoice. If you offer online payment methods, include a link directly in your invoices to give customers a convenient and straightforward way to pay their bills.

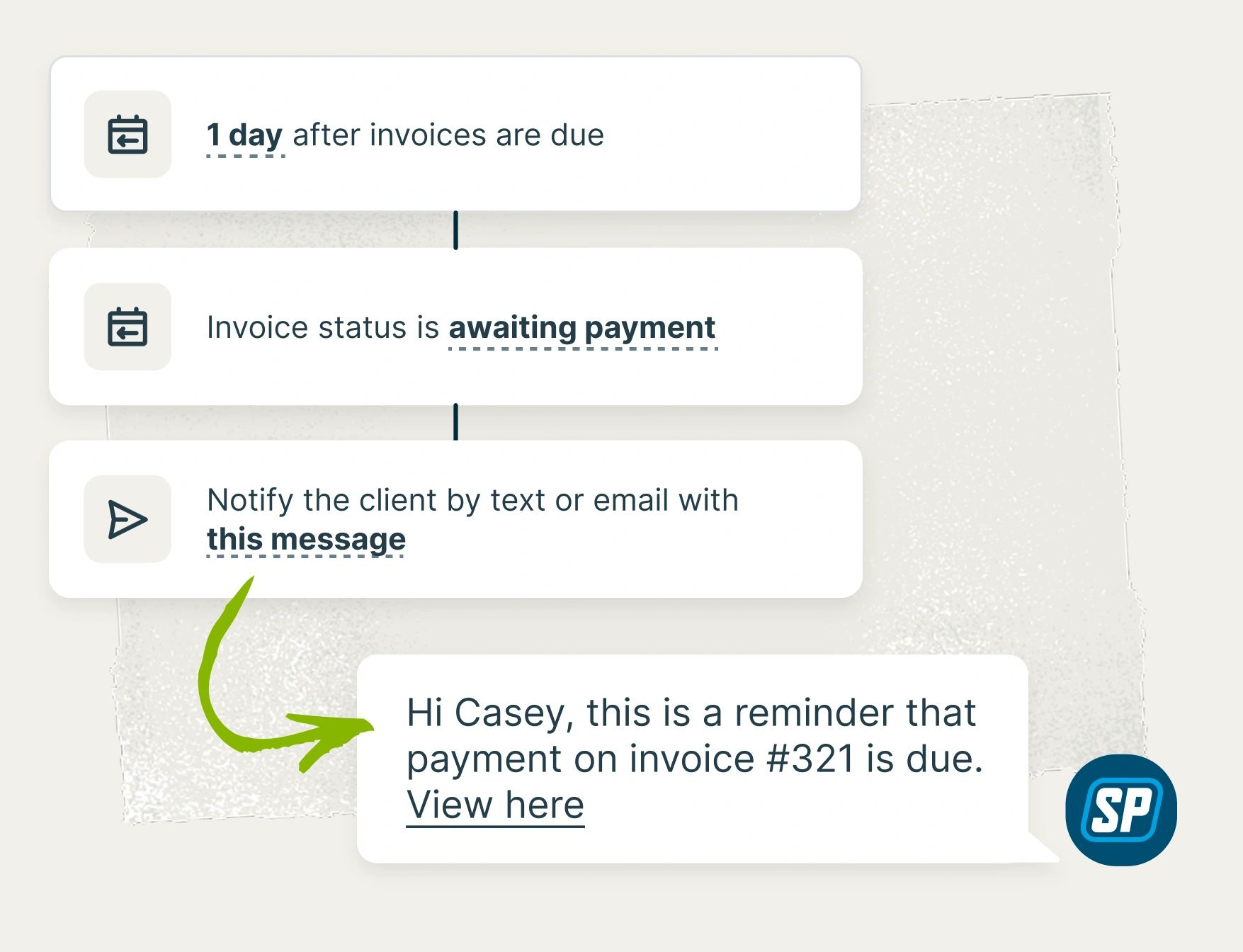

Send payment reminders

Track each customer in your CRM so you know when you have an outstanding invoice. Then, if an invoice goes past the due date, send the client a reminder. Sometimes, invoices slip a client’s mind, so sending a quick email is a good way to nudge them into action to avoid late payments.

Jobber’s invoicing software tracks unpaid invoices for you and automatically sends payment reminders to late clients.

3. Make it easy for customers to pay you

The easier it is for customers to pay you, the faster they’ll do it. By offering multiple payment methods, you give clients a way to pay you that doesn’t require withdrawing cash or visiting your office.

To make it easy for customers to pay you anytime from anywhere, consider accepting:

- Online debit and credit card payments

- ACH payments

- E-transfers

- Automatic payments for recurring services

With Jobber Payments, you can accept a variety of online and in-person payment methods, customizing your payment collection strategy to match your clients and services.

4. Reduce your expenses

Sometimes, cash flow issues are less about your revenue and more about costs. 46% of small business owners say inflation is their biggest challenge, and 75% have been significantly impacted by rising prices.

Reducing costs frees up working capital and reduces cash outflow. When possible, boost cash flow by:

- Downsizing your office space or hiring remote administrative workers

- Reviewing your bills to see if you can cut an unnecessary expense from your phone, internet, or software bills by changing your contract

- Taking a look at your inventory and equipment to evaluate what you use and what you don’t, then sell anything that’s gathering dust

- Leasing equipment instead of buying, especially if it’s something you only need for a single contract

- Talking to your suppliers about discounts for bulk orders or early payment discounts

- Hiring subcontractors for seasonal work or one-off jobs instead of employees

- Negotiating new contracts with vendors and suppliers

5. Boost your revenue

If you’ve already decreased costs but still have poor cash flow, think about how you can increase revenue instead.

Some effective strategies include:

Raising prices

The service pricing strategy you use makes a big difference to your cash flow. If you don’t charge enough, you won’t be able to cover costs.

How much you charge for your services depends on:

- Materials

- Labor

- Markup

- Profit margin

- Competitor pricing

- Your professional experience or qualifications

- The level of service you offer

For example, do you offer a premium experience or work in a niche, like luxury bathroom remodels?

While increasing prices can be uncomfortable, sometimes it’s necessary. As long as you communicate your value and reasoning to clients, set a fair rate for what you offer, and have a strategy in place, there’s no reason it shouldn’t go smoothly.

Just make sure to write an effective price increase letter to ensure your clients know when prices will go up and by how much.

Raise your prices. You need to review your pricing and make sure that you’re charging the right billable hour for your services. You’re probably too low, and it’s the quickest way to pull that profitability lever on your gross profit and bring it up.

Packaging services

Consider your service pricing and whether you can increase your profit margins by offering tiered pricing or packages.

Start by noting which services clients book the most and if it would make sense to bundle them together to increase the value of each job.

For example, let’s say you own a cleaning business and most of your clients book you for biweekly cleanings. If you notice a lot of them also book additional appliance deep cleans, it might be a good idea to offer a premium package at a higher price that includes a basic clean and kitchen appliance deep cleans.

Upselling and cross-selling

Upselling and cross-selling services also boost profit by making customers aware of other relevant services you offer.

The best way to increase a customer’s lifetime value is to sell them, cross-sell them, and upsell them other services.

For example, if a customer hires you to weed their lawn, you may notice they could benefit from custom fertilizer treatments. Or if you work in HVAC and you’re installing a new furnace and you notice the client’s air conditioning unit has seen better days, you could suggest a newer, more efficient option.

Mentioning that you also offer additional services customers may be interested in is a natural way to offer more value to a client and increase your takeaway.

Generating more leads

More leads mean the potential for more jobs. Expand your lead generation strategy by developing a referral program, using a lead generation platform, or leveraging existing clients to get repeat customers.

6. Offer customer financing to win more jobs

Sometimes, clients need work done even if they know they’ll struggle to pay for it, like emergency plumbing repairs or mold removal.

When this happens, it puts both of you in an awkward situation.

That’s where financing can come in handy. If you offer financing to customers, you get paid upfront from a lender while the client makes monthly payments over time.

This prevents your cash flow from being impacted and keeps you from having to deal with unpaid invoices.

With Jobber’s Wisetack integration, you can get paid upfront without having to worry about loan terms or payment collection.

7. Ask for deposits

Not all clients have good intentions. If you’re paying for job materials or supplies upfront, you’re putting yourself at risk if the client doesn’t make good on their invoice.

And, unfortunately, it’s impossible to tell whether a client’s going to skip paying you until it’s too late.

Asking for a deposit ensures you get the immediate cash you need to cover costs and gets the client financially invested in the job from day one.

We take a 50% deposit upfront if we’re going to wash your house, clean your roof, and clean your windows. That helped a lot with our cash flow issues.

8. Promote recurring services

The more recurring clients you have, the more consistent and reliable your cash flow will be—and the more profit you’ll make. In fact, recurring customers spend an average of 31% more than first-time clients.

And since getting a new customer costs between five to seven times more than keeping an existing one, retaining existing clients is a great way to improve cash flow.

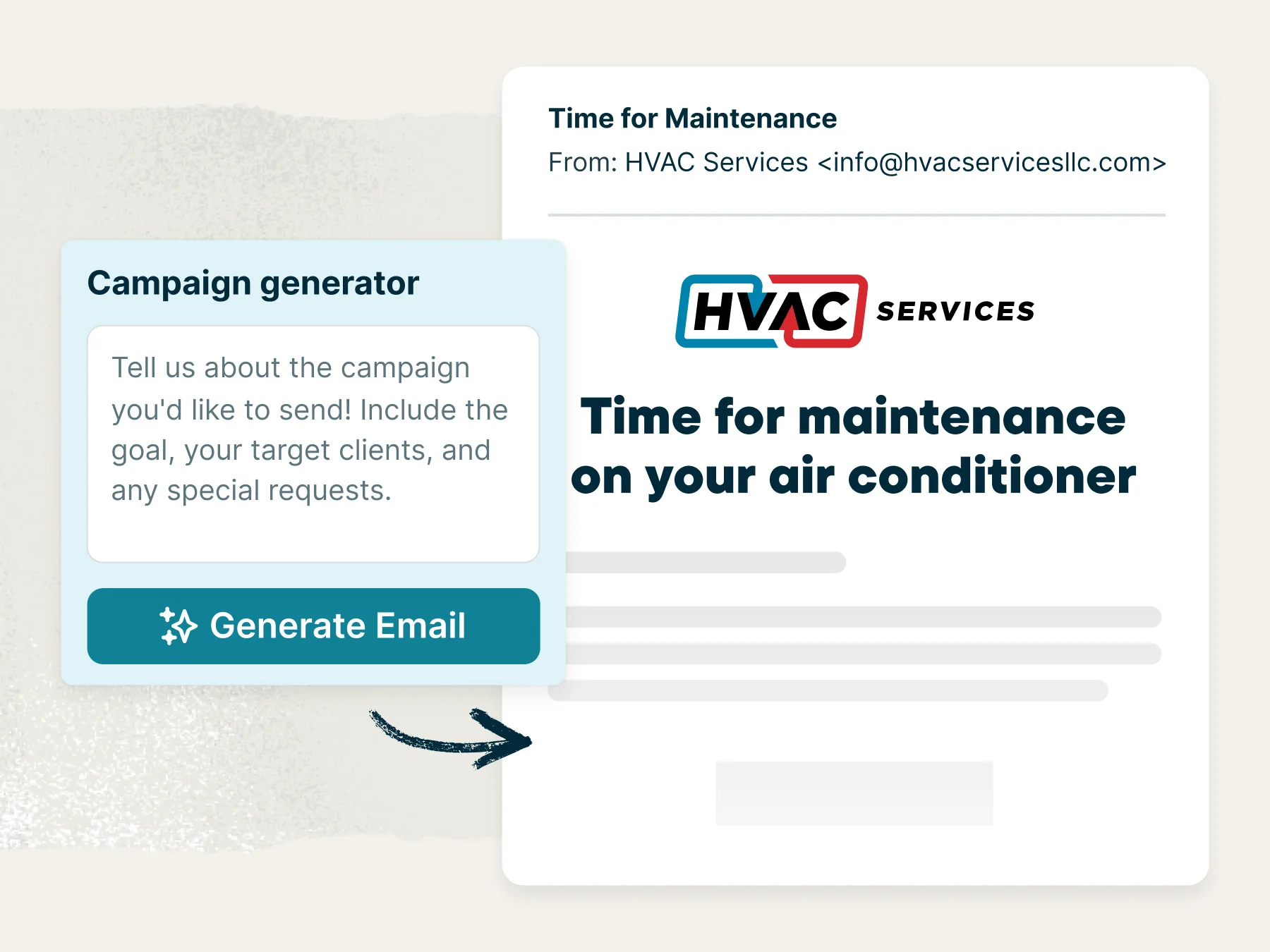

Recurring services can be things like house cleaning, lawn care, snow removal, or seasonal HVAC maintenance packages. Whichever you offer, make sure your clients know about it.

Then get as many on board with ongoing work as you can by making sure to promote it through your marketing efforts.

Use a tool like Jobber Campaigns to let clients know when they should book you for annual maintenance or switch from your mowing to shoveling service.

9. Plan for seasonal fluctuations

If you have a seasonal business, like landscaping, pressure washing, or roofing, prepare for the off-season by:

- Offering seasonal services like holiday light installation or snow removal

- Reducing your costs, like staffing and rent

- Setting aside money in your busy season to cover costs during slower months

Encourage early bookings and ask clients to pre-pay for seasonal packages to keep a steady cash flow by promoting seasonal services early and often.

10. Build a cash reserve

A cash reserve gives you money to rely on to cover unexpected expenses and fluctuating cash flows without going into debt.

To build a cash reserve:

- Start small. As long as your company is making a profit, you can contribute to a cash reserve each month. While the amount you contribute will vary based on your business’s revenue, 10% is a good starting point.

- Set a goal. Aim to set aside enough to cover 3-6 months of expenses, including payroll, bills, and labor.

- Keep it separate. Put your cash reserve in a separate account so it’s easy to track and access, but without getting lost in your everyday transactions.

- Pay back what you spend. If you use money from your cash reserve, adjust your budgeting to pay it back as quickly as possible. Depleting your reserve will only make it harder to build back up.

This will ensure emergencies don’t eat up cash flow, leaving you scrambling to cover regular monthly costs.

11. Prioritize reliable clients

When someone reaches out to ask for a quote or book a job, take a look at their client history.

Do they typically pay on time and in full? If they have a habit of paying late or only making partial payments, it might be time to fire them.

Your cash flow relies on building a list of trustworthy and high-quality clients. Focus on doing business with the ones you can rely on to pay you over the ones who don’t.

12. Use software for better cash flow management

Managing cash flow is essential for improving cash flow. It’s what ensures you’re prepared for unexpected costs, slow seasons, and emergencies without going into debt.

But tracking, managing, and boosting cash flow is a lot of work. Software like Jobber can make it easier by:

- Automatically monitoring overdue invoices and sending payment reminders

- Processing online payments to make getting paid easier

- Forecasting cash flow to predict cash inflow and outflow so you can plan ahead

- Spotting opportunities and risks through reports based on real business data

This allows you to make strategic cash flow decisions that support healthy business finances and help you grow.