Key takeaways:

Finding the best invoice app is key to getting paid quickly and efficiently, but the right tool depends on your business needs, size, and workflow.

- Top invoice apps offer a range of features for different business types. Options like Jobber, Invoice2Go, Zoho Invoice, QuickBooks Online, Square Invoices, and Invoice Simple cover everything from field service management to basic mobile invoicing and budget-friendly solutions.

- Ease of use and customization are critical. The best apps allow you to quickly create, send, and track professional invoices—often with templates and automatic reminders to speed up your workflow and reduce errors.

- Payment processing and integrations make a difference. Look for apps that accept multiple payment types (credit cards, ACH, mobile wallets) and connect seamlessly with the other tools and software you use, like accounting, payroll, or scheduling platforms.

- Features like invoice tracking, automation, and insightful reporting boost efficiency. Automated reminders, payment tracking, batch and progress invoicing, and business insights can help you stay on top of cash flow and get paid faster.

- Customer support and scalability matter for growth. Reliable support and flexible pricing plans mean you can get help when you need it and select the right plan as your business grows.

Send professional-looking invoices that get paid faster with Jobber Start your free trial.

Originally published in September 2024. Last updated on June 13, 2025.

Better, faster invoices lead to quicker payment collection—and you’ll save time customizing, tracking, and automating professional-looking invoices with a strong app.

But with so many options available, how do you choose the best invoice app for your specific needs? While many apps offer similar features, the right fit depends on your business size, workflow, and industry.

Check out our list of the best invoicing apps to find the right one for your small business type, team size, and day-to-day needs.

Our picks for the best invoicing apps:

How we chose the best invoice apps

We started by searching for apps made specifically for small businesses that need on-the-go invoicing. There’s a lot of invoicing software out there, but not all of it is mobile-friendly.

Then, we made a shortlist of apps based on data we collected from over a dozen customer review sites to get real-life customer feedback.

We watched app tutorials for every app on our shortlist and then narrowed it down to the ones with the easiest invoice experience and the most capabilities for small businesses.

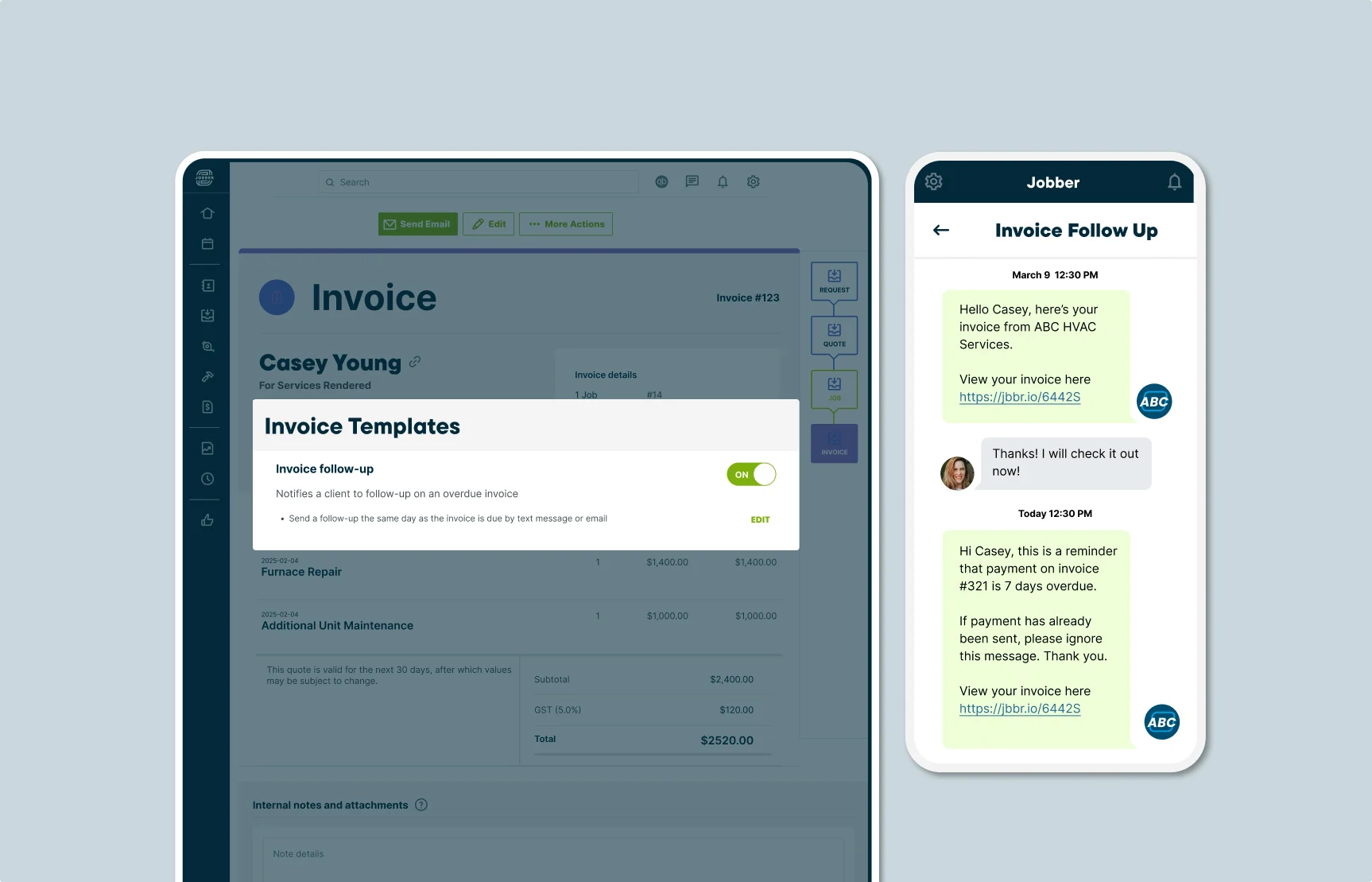

1. Jobber: best for field service businesses

Jobber is field service invoicing software that helps you manage jobs at every stage—from booking site visits, to quoting, scheduling, invoicing, and getting paid.

With branded invoice templates ready to go, you just fill in the job details and hit send. Then, collect payment how and when it works best for your customers: online or in-person. Jobber even offers automatic payments and Tap to Pay.

Jobber includes advanced invoicing tools, such as batch invoicing and progress invoicing, so you can break up large jobs into multiple payments and keep cash flowing as work gets done.

Because Jobber is built for mobile teams, its app is reliable, easy to use, and gives you full visibility from anywhere.

Jobber’s additional invoicing features include:

- See which jobs are ready to invoice, and get reminders to send invoices for jobs you’ve just finished

- Set up automatic payment reminders to help you keep track of invoice payments

- Offer a tipping option when customers pay invoices online

- Choose from multiple payment processing options, including ACH payments

- Keep track of your invoicing with AI-powered business insights

READ MORE: A guide to invoices versus receipts for service business owners

How easy is Jobber?

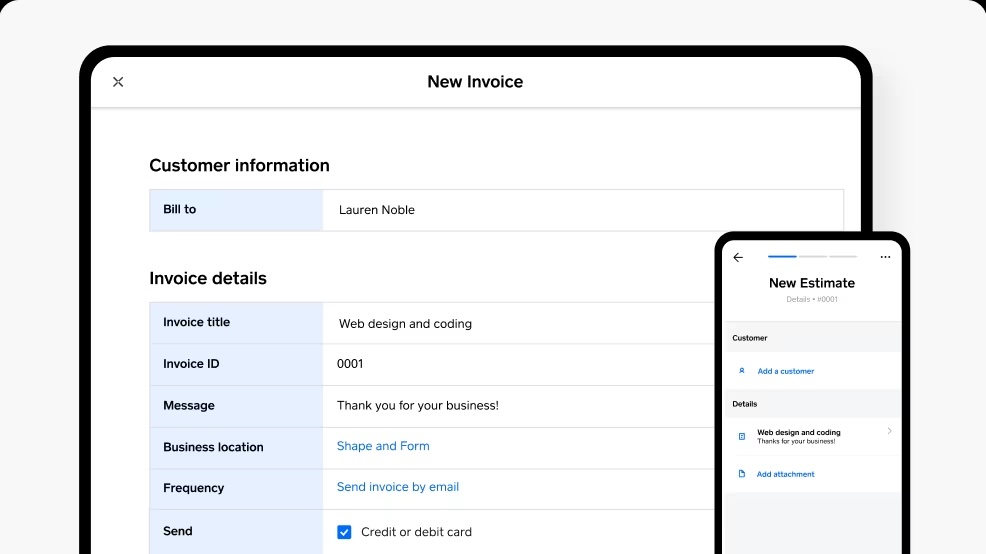

Invoicing in Jobber is simple and built to match the workflow of service-based businesses that provide quotes or estimates before starting a job.

If you’ve already written a quote or estimate for the job, all the services and pricing details will automatically copy over to your invoice—saving you time and reducing errors.

Once the job is complete, you can instantly generate a professional invoice, complete with accurate job details, that’s ready to send to your customers.

Starting with an invoice? It’s just as easy. Tap the big ‘+’ button at the bottom of your home screen, select “Invoice,” and either choose an existing client or add a new one. Then, enter your services, materials, and prices line by line.

| Integrations | • QuickBooks Online • Xero • Gusto • DocuSign • Zapier • And over 2,000 more popular apps |

| Customer support | • Live chat, email, and phone support available daily • Self-serve help center • In-product AI assistant • Award-winning support team |

Jobber has freed up so much of my time because I can convert jobs into invoices while I’m still in my truck.

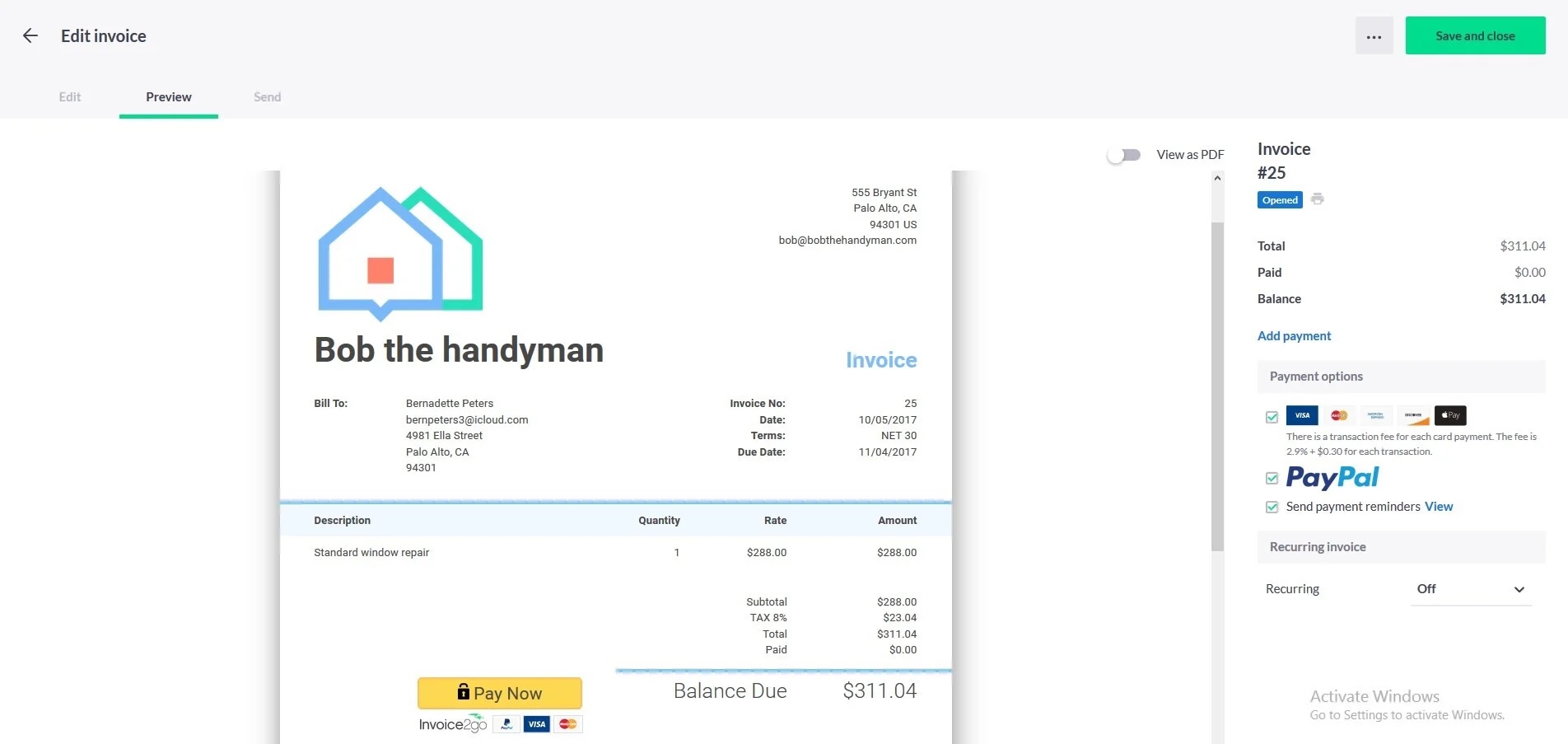

2. Invoice2Go: best for basic mobile invoicing

Invoice2Go offers mobile invoicing for small business owners who rarely work at a desk and only need basic invoicing features.

This small business invoice app is built specifically for smartphones and tablets, making it easy to build, send, and track invoices on the go.

Invoice2Go also offers other operations management features through its payroll and payment processing integrations with apps like QuickBooks and Xero. However, invoice creation is what this app does best.

Invoice2Go’s additional invoicing features include:

- Track the status of your invoices

- Convert bids and estimates into invoices

- Collect payment by credit card, debit card, bank transfer, or PayPal

- Send invoices directly through messaging apps like Facebook Messenger or WhatsApp

How easy is Invoice2Go?

Invoice2Go keeps invoicing straightforward and even a bit fun, especially for template customization.

On the app’s home screen, you’ll see two options for creating an invoice: an “Invoices” button on the bottom menu and a ‘+’ icon.

The app provides a helpful walkthrough the first time you create an invoice and lets you scroll through easy-to-edit document template options.

Once you’ve set up your invoice preferences—like your default tax rate and invoice reminder schedule—invoicing in the app is fast. You just have to add your service line items and prices on a simple screen, then choose how you’ll send the invoice.

That said, you’ll need to evaluate your business needs to choose the right plan, as Invoice2Go’s Starter and Professional plans only let you send 30 and 100 invoices per year, respectively. Plus, you only get access to accounting integrations with the Professional plan.

If unlimited invoices and accounting features are important to you, you might want to seek a more comprehensive solution such as Jobber.

| Integrations | • Connects with 13 apps, including Google Drive, Shopify, and Xero |

| Customer support | • Must submit a request or chat on their website • No in-app support |

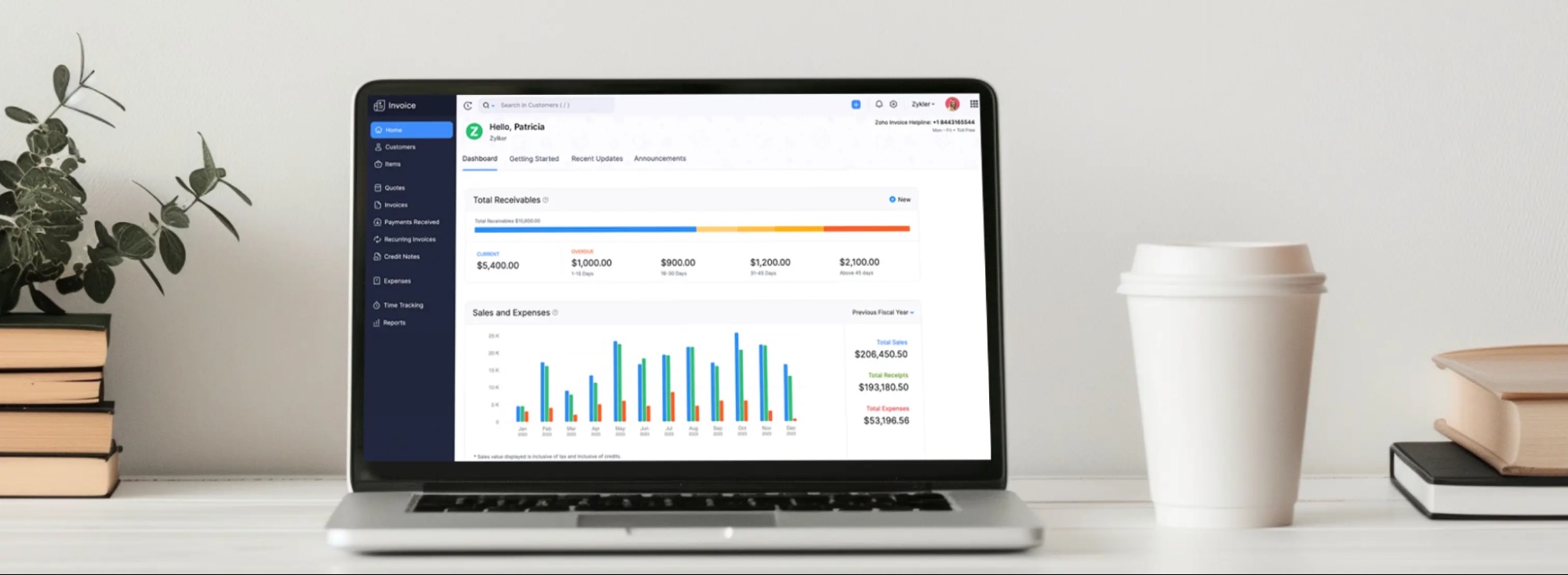

3. Zoho Invoice: best for teams on a tight budget

Zoho Invoice is the best free invoice app for small businesses on a tight budget.

It costs nothing to create, send, and track invoices through Zoho Invoice. You just have to pay credit card processing fees when you accept customer payments.

Additional invoicing features include:

- Customize the sender, CC, and subject line of your email before sending an invoice

- Track the status of your invoices

- Send automated invoice payment reminders

How easy is Zoho Invoice?

Zoho Invoice lives up to its name—it’s focused on one task and hard to get lost in. You can add or modify invoice details from one screen and preview your invoice before sending it.

In one tap, you can connect the invoice to your preferred payment gateway, such as PayPal or Stripe.

What makes Zoho Invoice stand out is that it’s built around popular iOS and Android features. On iPhones and iPads, you can send invoices to customers through iMessage and use Siri to set reminders for your transactions. You can also get reminders sent to your Apple Watch.

On Android, you can add a Zoho Invoice widget to your home screen and create invoices without even opening the app.

Although Zoho Invoice is free, you’ll need to integrate with a payment gateway to process payments. If you want a smoother invoicing process from beginning to end, it’s better to choose an invoicing tool with integrated payment software such as Jobber.

| Integrations | • Connects with all other Zoho products (Zoho CRM, Zoho Projects, etc.) • Works with Stripe, PayPal, and Square |

| Customer support | • Support is available by email or a support form on their website • No in-app support |

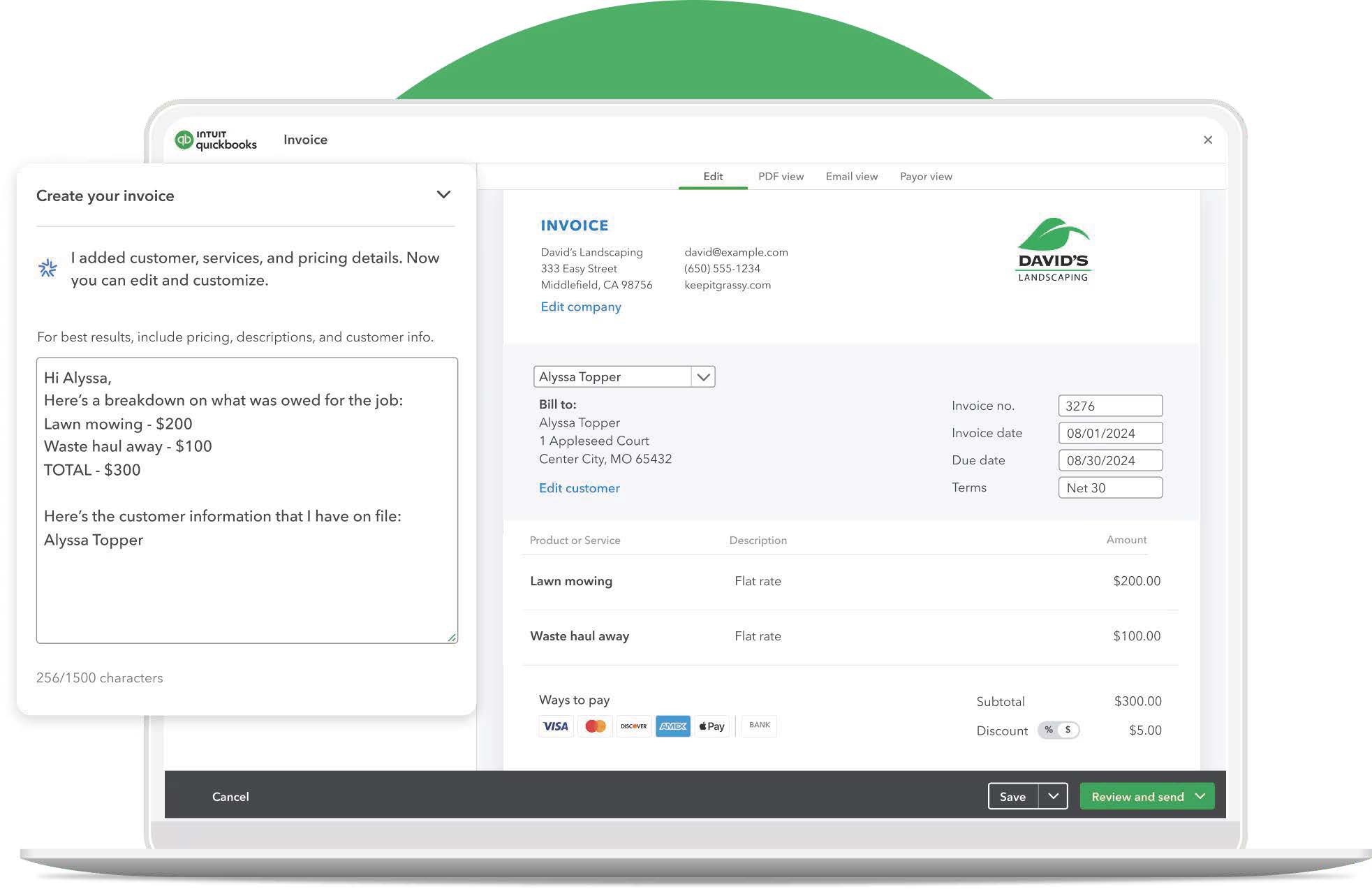

4. QuickBooks Online: best for all-in-one invoicing and accounting

QuickBooks Online is the best invoice app for accounts receivable management. The QuickBooks app improves cash flow from the moment you create an invoice to your month-end reporting.

If you don’t want to bounce across multiple apps to manage your invoicing and accounting, QuickBooks Online is a great place to keep those tasks together. It offers every essential invoicing feature—like customization, automatic payment reminders, and batch invoicing.

After you send an invoice, you can run an accounts receivable aging report to see which customers are late paying and how much cash you have in your business bank account to pay your bills.

Additional invoicing features:

- Send progress invoices at multiple milestones of a project

- Link billable expenses to your invoices

- Set up alerts to know when customers pay invoices

- Schedule recurring invoices

READ MORE: A guide to business expense trackers for service providers

How easy is the QuickBooks mobile app?

The QuickBooks mobile app opens to a simple menu with icons you can click to start everyday tasks—including invoicing.

If you haven’t already uploaded product and service details to your QuickBooks Online account, you can add them to an invoice right from your phone.

Thanks to color-coded buttons and intuitive menus, it’s easy to find what you need across all sections of the QuickBooks mobile app.

For home service businesses, QuickBooks Online is more powerful when used alongside field service software. With Jobber’s QuickBooks Online integration, you can connect your accounting and operations workflows to create an all-in-one solution for your business.

| Integrations | • Shopify • Jobber • SOS Inventory • And many more |

| Customer support | • Quick setup and onboarding • Live chat, phone, and email support |

5. Square Invoices: best for simple invoicing and payment collection

Are you just starting out your business, or simply prefer to work solo? Square Invoices is the best invoice app for simple invoicing and payment collection.

Square’s mobile app is user-friendly and lets you send invoices, accept payments, and track jobs on the go—ideal for technicians on the go.

You can accept card payments, ACH, Apple Pay, or in-person payments using Square’s reader. Fast and flexible payment options reduce the chances of delayed payments.

READ MORE: The Top 9 Field Service Apps to Boost Efficiency

Square’s additional invoicing features:

These features are available on Stripe’s web app:

- Track which invoices are paid and unpaid from everywhere

- Choose from multiple custom invoice templates

- Stay organized with project folders

- Use milestone-based payment schedules to control cash flow

How easy is Square?

Square Invoices is built for speed. From the dashboard or mobile app, you can create and send an invoice in just a few steps, without toggling between menus or tools.

You’ll start by clicking “Create Invoice” right from the Invoices tab. From there, you can add a customer, enter line items with prices and descriptions, set a due date, and choose whether to allow tips or partial payments.

Sending the invoice and collecting payment are part of the same flow. You can preview the invoice before sending it, and once it’s delivered, your client can pay instantly.

Plus, if you’re on a budget, Square has a free plan that includes unlimited basic invoices and unlimited clients.

Better yet, with Jobber and Square you can access job details, track time, invoice on the go, and get paid faster with online invoice payments.

| Integrations | • Square Invoice integrates with accounting software like QuickBooks and Xero |

| Customer support | • Phone support Monday-Friday 6:00 am – 6:00 pm PDT • 24/7 chat support |

6. Invoice Simple: best for small teams

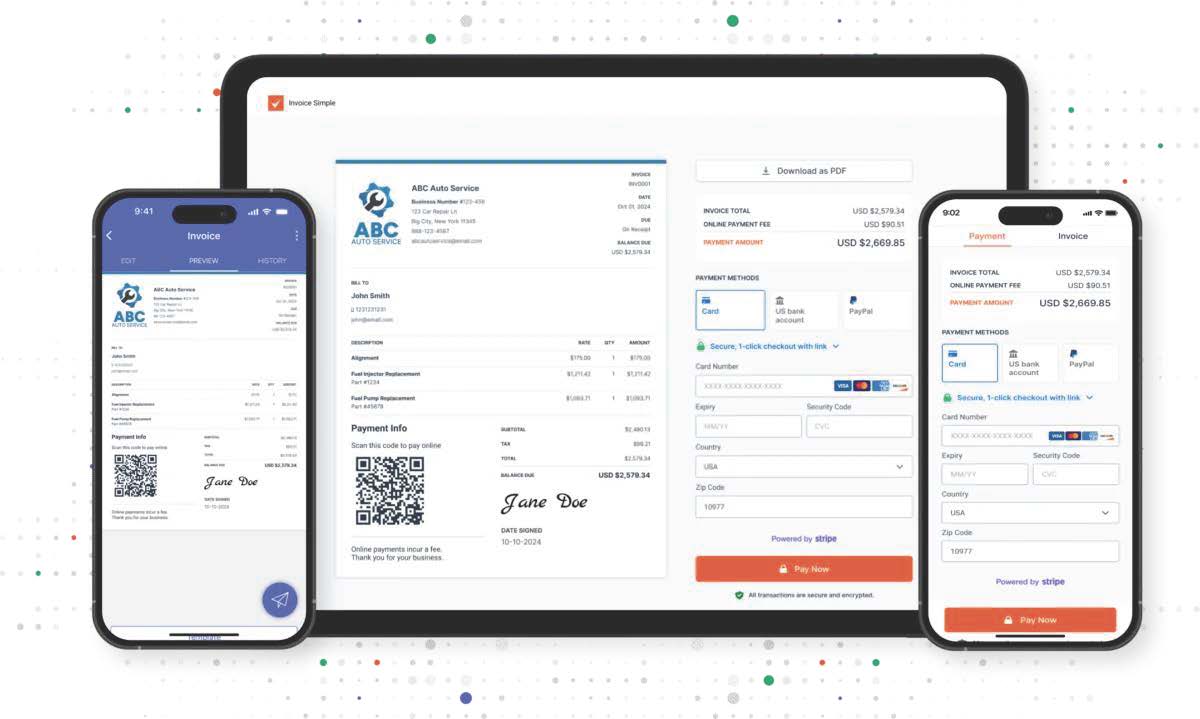

Invoice Simple is one of the best invoicing apps for small field service businesses.

Invoice Simple’s mobile app is built for field use. You can create, send, and manage invoices from your phone or tablet while on-site. You can also generate and save invoices without an internet connection and send them once you’re back online

Invoice Simple’s additional invoicing features:

- Create estimates and convert them to invoices

- Accept card payments through various payment methods

- Track cash and checks easily

How easy is Invoice Simple?

Invoice Simple lives up to its name. The app’s interface is simple, clean, and intuitive, making it ideal for field workers who don’t want to deal with a steep learning curve.

In the app, tap “Create Invoice,” then quickly fill in your customer’s name, add line items, and set payment terms. You can also customize the invoice with your logo, notes, or tax rates.

Customers can pay online from any device with a credit or debit card, and other popular payment methods, including ACH, PayPal, Venmo, Stripe Link, Apple Pay, and Google Pay.

Invoice Simple has three plans, but only the Premium plan has unlimited invoices. The app also doesn’t allow for multi-user access, which makes task delegation and general team management difficult.

| Integrations | • Stripe • PayPal |

| Customer support | • 24/7 email and in-app support available daily • No phone support |

What to look for in the best invoice apps for small businesses

Many of the best invoice apps share the same features—but some will fit your business better than others.

The type of business you run will determine the type of invoices you need and the invoicing best practices you should follow.

For example, if you run a lawn care business, you might need an app that supports recurring invoices and payments. If you’re a contractor hired for a large job, you might prefer progress invoices.

You might also want to add credit card authorization forms to your invoicing process and look for a tool that allows for this.

Think about the problems or inefficiencies you’re trying to solve, then consider the following features when choosing an invoicing app:

- Ease of use. Is it easy to find what you’re looking for when you open the app? How many steps does it take to create and send an invoice? Keep in mind: apps with accounting and payroll features could take longer to learn, but shouldn’t be stressful.

- Invoice tracking. Your invoicing app should give you a clear picture of who’s paid and who hasn’t. Beyond that, you might want alerts when someone opens an invoice or the ability to set late fees for unpaid invoices.

- Automated payment reminders. Look for an app that helps you remind customers about unpaid invoices. Some apps offer email and text templates. Others let you send those messages automatically on a schedule you can set yourself.

- Pricing. Expect to pay a monthly subscription fee if you want an app that comes with quoting, scheduling, accounting, or other features beyond invoicing. Some invoice-only apps just charge payment processing fees.

- Integrations. Do you use other software that needs to connect with your invoicing app? Check if the invoice apps on this list integrate with the accounting software, scheduling apps, and CRM apps that you already use and don’t want to replace.

- Customer support. Your invoicing app should have a reliable support team you can reach fast if you get stuck or want more out of the software. Read customer reviews to get a sense of the app’s quality of support.

Choosing the best invoice app comes down to your workflow, team size, and how you do business in the field. Whether you need something simple or more robust, the right tool can help you get paid faster and keep cash flow moving with minimal effort.