Best Invoice App: Top 8 Choices for Small Businesses

Better, faster invoices lead to quicker payment collection—and you’ll save time customizing, tracking, and automating professional-looking invoices with a strong app.

But how do you choose the best invoice app for your business when there are hundreds of options out there? Many of these apps offer the same features, but they’re not all the best fit for your specific invoicing needs.

Browse our list of the best invoicing apps to find the right one for your small business type, team size, and day-to-day needs.

Our top 8 best invoicing software picks:

-

Jobber: best invoice app for field services

-

Stripe: best for product-based and e-commerce businesses

-

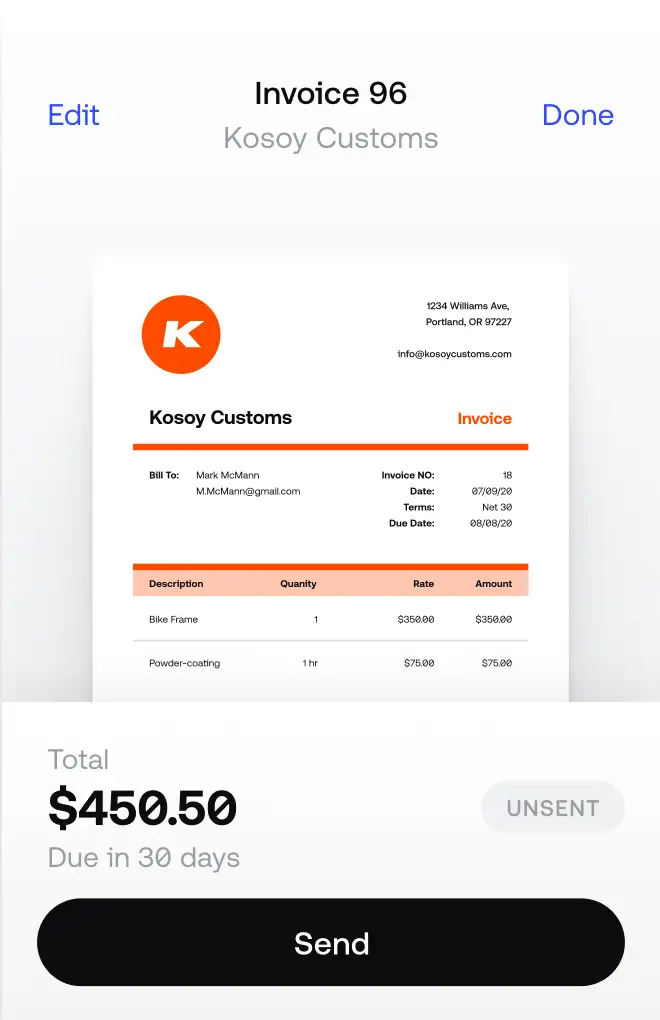

Invoice2Go: best for mobile invoicing

-

QuickBooks Online: best for invoicing and accounting

-

Wave: best free invoice app

-

HoneyBook: best for creative teams

-

Bill: best for vendor invoicing

-

PandaDoc: best for sales teams

Disclaimer: App prices are subject to change after the publication of this article.

1. Jobber: best invoice app for field services

Jobber helps field service businesses instantly invoice customers and get paid faster. Built for businesses that work on customer properties and spend the day on the move, Jobber is an easy-to-use and cost-effective field service invoicing app.

Invoicing with the Jobber app is simple once you’ve provided your service—with one tap, generate a professional invoice complete with accurate job details and convenient payment options, ready to send to the customer.

Here’s how Jobber can improve your invoicing:

- Customize customer-friendly templates with your company branding, contact information, and your own message or disclaimer

- See which jobs are ready to invoice, and get reminders to send invoices for jobs you’ve just finished

- Send invoices in batches to save time and boost cash flow with just a few taps

- Automatically send a customized email or text follow-up to customers, reminding them to pay their outstanding invoice

- Print invoices if your customers prefer snail mail—Jobber will queue up invoices and envelope labels for printing

- Automatically send receipts when an invoice has been marked paid

- Accept online card payments, bank payments, or get paid in person with the Jobber Card Reader

| Pros: | Cons: |

| • Easy setup process • Offers optional tip collection when customers pay invoices • Offers instant payouts (including weekends and holidays) for an additional 1% fee • Award-winning support team • Syncs with QuickBooks Online and other popular accounting apps • Team members can use the Jobber app in English or in Spanish to manage day-to-day work in the field | • Limited invoice styling options • Not ideal for product-based businesses |

2. Stripe: best for product-based and e-commerce businesses

Stripe is the best invoicing app for businesses that sell physical merchandise, in person or online. It’s not just a popular payment processing tool—Stripe is great for invoice creation, automated invoice follow-ups, and reporting.

From your Stripe product catalog, it’s easy to create and manage merchandise items, then see reports on your best-selling inventory. Then grab items from your catalog, select quantities, and add them directly to your invoice.

In Stripe, you can customize your invoice with your company branding and a thank-you note. Stripe lets you send invoices for free—you only pay a processing fee when your customers pay invoices online.

| Pros: | Cons: |

| • Smooth invoice payment experience • Instant payouts available • Automatic invoice reconciliation • Customizable reports available for item sales and transactions | • Limited invoice customization on the Stripe Mobile App • Not for teams that need project management features |

Other Square invoicing features:

- Schedule recurring invoices for product subscriptions

- Send one invoice to multiple customers at once

- Save and charge credit cards on file

- Track invoice and payment statuses in real time

Starting price: 0.4% per paid invoice. 2.9% plus 30 cents per successful card charge.

READ MORE: Payment reminder emails: 5 templates to send to customers

3. Invoice2Go: best for mobile invoicing

Invoice2Go offers mobile invoicing for small business owners who rarely work at a desk and only need basic invoicing features. This invoice app is built specifically for a smartphone or tablet so you can build, send, and track invoices at the tap of a finger.

Invoice2Go offers a few other operations management features through partnerships with payroll and payment processing services, but invoice creation is what the app does best.

Get an invoice started with one of 8 professional templates, then add your company logo, a banner, and even a watermark to mark invoices as “paid.” See the statuses of your paid and unpaid invoices under two simple tabs.

| Pros: | Cons: |

| • Easy setup and navigation • Invoices look professional • Connects with QuickBooks Online • Add unlimited users to one account | • Unlimited monthly invoices only available on their Premium plan • No instant payouts (processing takes 3-4 business days) • Credit card processing fees as high as 3.5% • Free trial doesn’t include all features |

Other Invoice2Go features:

- Track the status of your invoices

- Convert bids and estimates into invoices

- Collect payment by credit card, debit card, bank transfer, or PayPal

Starting price: $5.99/month, or 9.99/month for up to 5 invoices per month.

4. QuickBooks Online: best all-in-one invoicing and accounting solution

QuickBooks Online is our top choice for improving accounts receivable management, from the moment you create an invoice to reporting on A/R and cash flow.

It’s the best invoice software for businesses that want to manage their invoicing and accounting without bouncing across multiple apps.

QuickBooks Online offers every essential invoicing feature, like customization, automatic payment reminders, and batch invoicing.

You also get progress invoicing, which means you can invoice clients partially for deposits and after certain milestones or stages.

After you send an invoice, you can easily run an accounts receivable aging report to see which customers are late paying and how much cash you have in your business bank account to pay your bills.

| Pros: | Cons: |

| • Easy to customize invoice templates and send to customers • Advanced reporting on accounts receivable • Quick setup and onboarding • Live chat, phone, and email support | • More expensive than non-accounting invoice apps • Limited inventory management and project management features |

Other QuickBooks Online invoicing features:

- Convert estimates into invoices

- Link billable expenses to your invoices

- Set up alerts to know when customers pay invoices

- Schedule recurring invoices

Starting price: $22/month

5. Wave: best free invoice app

Wave is a free invoicing app that works great for freelancers, startups, and any small business on a tight budget. Create, send, and track invoices for free, and only pay credit card processing fees when you accept payments online.

The invoice builder and reports in Wave are sleek and intuitive, so you’ll save time on top of saving money. From a clutter-free invoice tracking dashboard, you can see your total amount due from all outstanding invoices.

| Pros: | Cons: |

| • Free invoicing features that most apps charge for • Free to add unlimited users • Unlimited bank and credit card connections | • Limited number of invoice templates • Not ideal for printed invoices • No tip collection option • Customer support is only available via email |

Other Wave invoicing features:

- Track the status of your invoices

- Set up automatic credit card payments

- Send automated payment reminders

Starting price: Free to invoice. Payment processing fees are 2.9% plus 60 cents per credit card transaction.

6. HoneyBook: best for creative teams

HoneyBook is the go-to invoicing app for many creative businesses. Teams that offer design, photography, entertainment, and other creative services need to look attractive to clients—and HoneyBook offers the best creative customization of all invoice apps.

To get started, you can choose from a large invoice template gallery with designs tailored to different business types. Then edit the invoice’s background color, padding, and text styles, and even add a header image.

HoneyBook lets you make design edits on a live document instead of waiting for a preview on a separate screen.

In a sidebar, you’ll find settings for recurring invoices, discounts, taxes, and payments that you can update without leaving the invoice creation screen.

| Pros: | Cons: |

| • Advanced invoice design tools • Invoice payment, discount, and taxation settings are easy to adjust • Allows clients to leave an optional tip | • No option to email an invoice PDF directly from the app (only accessible through a client portal) • Payment confirmation emails are slow to arrive • No receipt customization |

Other HoneyBook invoicing features:

- Add a contract to your invoice

- Set up alerts to know when customers pay invoices

- Automatically charge customers for recurring services

- Accept payments on a scheduled or recurring basis

Starting price: $16/month (if billed annually)

7. Bill: best for vendor invoicing and payments

Bill is the best invoicing app for businesses that need to manage vendor relationships. This app comes with strong accounts payable tools like easy invoice imports and an automated bill approval process.

When vendors email you their invoices, you’ll receive them directly in your Bill app inbox where your outgoing invoices are also stored. Then, you can pay vendors with credit card, check, ACH, and even international wire transfer.

| Pros: | Cons: |

| • Add multiple approvers to your invoices • Accept electronic ACH payments • Detailed transaction audit trails available | • More expensive than most invoice apps • Setup and implementation can be lengthy • Customer support can be difficult to reach |

Other Bill invoicing features:

- Create custom fields for your invoices

- Send recurring invoices

- Track invoice and payment statuses

- Pay vendors and accept payments through an online portal

Starting price: $79/user/month

8. PandaDoc: best for sales teams

Thanks to its advanced document activity reporting, PandaDoc is our top invoice app choice for sales teams. PandaDoc helps you analyze the success of your proposals and invoices by showing detailed activity reports on every document you send.

Get alerts every time a client document gets opened, read, and signed. The app has ready-made reports that show those results for all your documents.

| Pros: | Cons: |

| • Large document template collection • Create and send contracts • Easy e-signature collection • Document activity reporting and notifications | • Can be difficult to navigate • Must subscribe to a paid plan to get invoice templates and customer support • Per-user pricing can get expensive |

Other PandaDoc invoicing features:

- Use ready-made templates to build invoices

- Track the time spent on each invoice page

- Set up automated reminder emails

- Accept customer payments online

Starting price: Free; paid plans start at $19/month/user (if billed annually)

What to look for in an invoicing app

Most invoicing apps these days have the same features—but some will fit your business better than others. Carefully look at the tools each app provides, and choose the app that excels at whichever features are most important to you.

Evaluate these features when choosing your invoicing app:

- Ease of use. Is it easy to find the tools you’re looking for? How many steps does it take to create and send an invoice? All invoicing apps should be easy to use, but apps with accounting and payroll features may take longer to learn.

- Invoice scheduling options. Do you need to send progress invoices for larger projects? Do you accept recurring payments for regular customers? Pay attention to invoice scheduling settings when you’re shopping for an invoice app.

- Customization. Do you only need a company logo and contact details on your invoices, or are custom colors and designs important? Some apps have branding limitations that could influence your choice.

- Automated payment reminders. Look for software that offers templates for invoice payment reminder messages, lets you customize them, and sends them automatically on a schedule you set.

- Tracking. Your invoicing software should give you a clear picture of who’s paid and who hasn’t. Beyond that, you might want alerts when someone opens an invoice, or details on when a customer last opened their unpaid invoice.

- Online payment processing. Most invoice apps let you accept online payment from customers. But each app offers different payment methods and processing fees, and may or may not provide a tip collection option.

- Analytics and reporting. A good invoicing app offers reports that help you evaluate how well your payment terms, late payment fees, and reminders help you collect payment faster.

- Integrations. What other software do you need your invoicing app to connect and communicate with? See if your invoice software integrates with the mobile field service apps, accounting apps, scheduling apps, or CRM apps you already use and can’t replace.

- Customer support. See what customers say about every app’s customer support team. Are they easy to reach, responsive, and helpful? A great support and setup team can also show you how to get the most from the software.