Key takeaways:

Getting paid quickly and reliably is essential for keeping your service business running smoothly. These strategies can help ensure the money keeps coming in on time.

- Ask for deposits and clearly communicate payment terms. Collecting a deposit up front secures commitment from clients, while outlining payment expectations, accepted methods, and penalties helps prevent confusion and delays.

- Send professional digital invoices. Issue invoices right after work is completed and use software to include all necessary details, customize branding, and make it easy for clients to pay online or via mobile.

- Offer multiple payment and flexible schedule options. Accept various payment methods, such as credit/debit cards, ACH transfers, or cash, and consider offering financing or monthly payment plans to help clients manage larger bills.

- Use incentives and reminders to encourage early payments. Provide discounts for early payments and send automated reminders before due dates to encourage on-time payments and minimize chasing overdue invoices.

- Leverage payment processing tools to streamline collections. Platforms like Jobber help you automate invoicing, follow-ups, and recurring payments, reducing manual effort and improving cash flow.

For more tips like these to help your service business thrive, sign up for the Jobber Newsletter.

Originally published in July 2017. Last updated on November 6, 2025.

As a service business owner, getting paid in full and on time is a great feeling. You’ve provided a quality service, and are being compensated for that hard work.

This is why it’s so stressful and disappointing when a client’s due date rolls by without payment.

Late payments occur for a number of reasons, like a client’s forgetfulness or lack of funds. But that doesn’t mean you should waste time and money texting reminders or driving around to collect soggy checks.

Using a good payment collection process can help you get paid faster, boost cash flow, and prevent late payments without the extra footwork.

Use these tips to learn how to collect payments from customers to encourage timely payments and keep your business running smoothly.

Tips for collecting payments from customers:

-

Ask for a deposit

-

Communicate clear payment expectations

-

Send an invoice

-

Offer multiple payment methods

-

Use early payment incentives

-

Provide flexible payment options

-

Set up recurring billing

-

Send payment reminders

-

Try different contact methods

-

Use software to upgrade your payment collection process

-

What do you do if a customer doesn’t pay you?

1. Ask for a deposit

Asking for a deposit before a job begins ensures you have the funds you need to purchase materials, cover labor costs, and commit to the work.

It’s also an effective way to make sure a client is invested in a project from the get-go, weeding out noncommittal clients and those who may not plan to follow through with payment.

When can you ask for a deposit?

But before you ask for a deposit, it’s important to check your state’s laws since requirements and regulations vary. Some states cap the down payment or impose special handling rules.

Once you know your state’s requirements, make use of them! Deposits typically work best for:

- Projects with high material costs, like luxury countertops or custom water features

- Big jobs that have large price tags, like extensive renovations

- New bookings from first-time customers

How much of a deposit should you ask for?

Deposit amounts vary based on the job and your industry, as well as your state’s legal requirements. For example, if you’re doing a home renovation or swimming pool job in California, the down payment can’t be more than $1,000 or 10% of the contract price, whichever is less, excluding finance charges. There are no exceptions for special-order materials.

For home service businesses, you should ask for enough to either cover the cost of materials or a portion of the labor. That can be anywhere from 10%-50% of the total estimate.

Every single project we do, I need an approval and I need a 50% project deposit. That’s my thing.

I’ve had some people bark at it or be weird about it, but for the past five years, it’s 50% upfront, 50% on the backend.

Pro Tip: To cover costs on big or long-term jobs, use progress invoicing. It’ll ensure you have the money you need to complete the project without going into the red.

2. Communicate clear payment expectations

Before a job begins, clearly state your payment terms, such as:

- How much the job will cost, including taxes and material costs

- Which payment methods you accept

- When payment is due

- Whether a deposit is required

- When you will send an invoice

- What happens if they pay late

- Whether you offer early payment discounts

It’s beneficial to go over this in person with your client and to include it on quotes, invoices, and contracts. If you have a website, you can add it to a page outlining your terms and conditions.

If a client understands and agrees to your payment expectations upfront, they’re more likely to follow them when they receive an invoice.

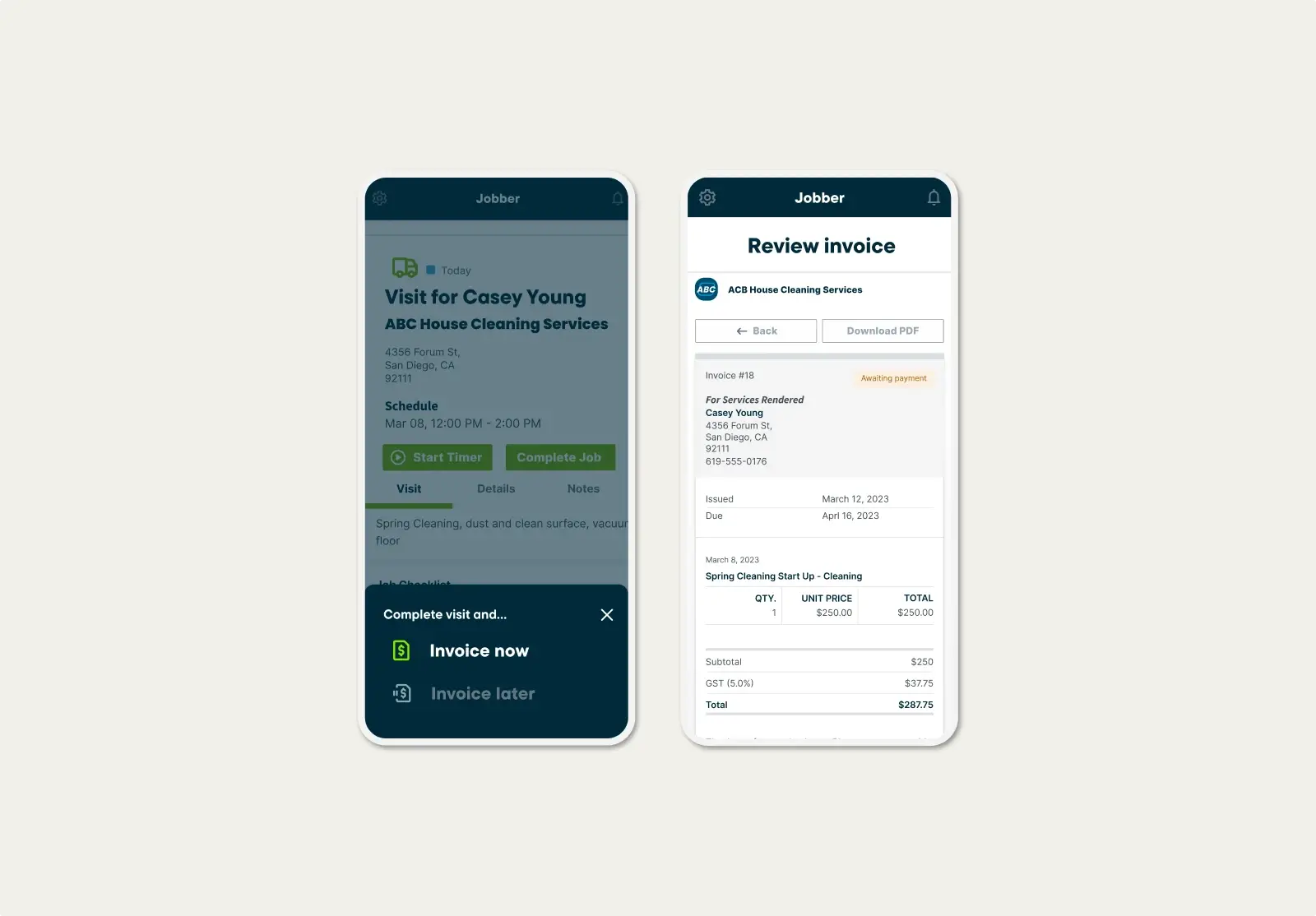

3. Send an invoice

If you don’t send an invoice, a client won’t know payment is due. At the end of every job, provide an invoice that includes:

- An invoice number for easy tracking and reference

- Your business information

- Client details, such as a name and address

- The total amount due after taxes, discounts, and deposits

- The payment due date

- Payment instructions, like which payment methods you accept

- Payment terms, like whether you charge late fees or interest on unpaid bills

While you can send paper invoices to customers, they can get lost or damaged in transit. Digital invoices are a better option since they’re easier to track and more convenient for clients.

You can use invoicing software like Jobber to:

- Create and send professional invoices, with custom images and company branding

- Add payment links to invoices to get paid faster

- Send invoices via email or text

- Automatically follow up on outstanding invoices

4. Offer multiple payment methods

By offering multiple payment options to customers, you make it easier and more convenient for them to pay you. For example, you can accept:

- Credit card payments

- Debit card payments

- Tap to Pay

- ACH payments

- Cash

- Checks

Which payment methods you offer will depend on how and where you deliver your services.

For example, if you typically work on-site, like a handyman, collecting customer payments in person may be ideal. But if your services take place without the client around, like a cleaner or lawn care specialist, online payment options may work best, so that you don’t need to spend time driving back to the site to collect payment.

I had plenty of soggy checks and cash, and I’d have to lay them in the sun to dry.

ow, I can go cut a lawn, send my customer the invoice, and they can pay at their leisure. Online payments and invoicing make me look professional.

5. Use early payment incentives

Payment incentives encourage clients to make early payments by offering them a small discount, such as:

- 5% off for payments made by a certain date

- 10-20% off a future service

For example, you could offer a payment discount if a client pays within 10 days of receiving an invoice, or 15% off their next service of $250 or more.

It helps to boost cash flow and prevent late payments, while rewarding customers who pay before their invoice due dates.

6. Provide flexible payment options

Large invoices can be hard for clients to pay all at once. Allowing them to make monthly payments through in-house or third-party customer financing helps them manage their budget while providing you with incoming cash.

For example, you can offer monthly payment plans for bills over $1500 through your business, like $300 a month over five months.

Or you can use a customer financing platform to handle customer loans instead. For a fee, they provide the customer with a loan and pay you for the total invoice upfront.

Not only does this help you to get paid faster, but it can also win you more jobs, since it provides payment options to customers who may not be able to afford your services otherwise. Like those with smaller budgets who need emergency repairs done.

My customer was extremely grateful to have this consumer financing option.

The repair came at a really bad time for her, and she was left with a really good feeling. It’s an amazingly easy process, too.

7. Set up recurring billing

Recurring billing is when you use pre-authorized credit card payments to charge clients for ongoing work on a rolling basis. This kind of automatic payment works great for weekly cleaning, biweekly lawn care, or seasonal snow removal.

You can use a credit card authorization form to get the client’s permission to set up recurring billing. Then, process payments for the pre-approved amount on the same day each week or month as agreed on by the client.

Or, use payment processing software like Jobber to automate recurring payments for you.

It’ll save both you and your client time, free up cash flow, and prevent you from having to send payment reminders.

Just make sure that you still send an invoice and receipt to the client for their records, and get permission before charging for additional services.

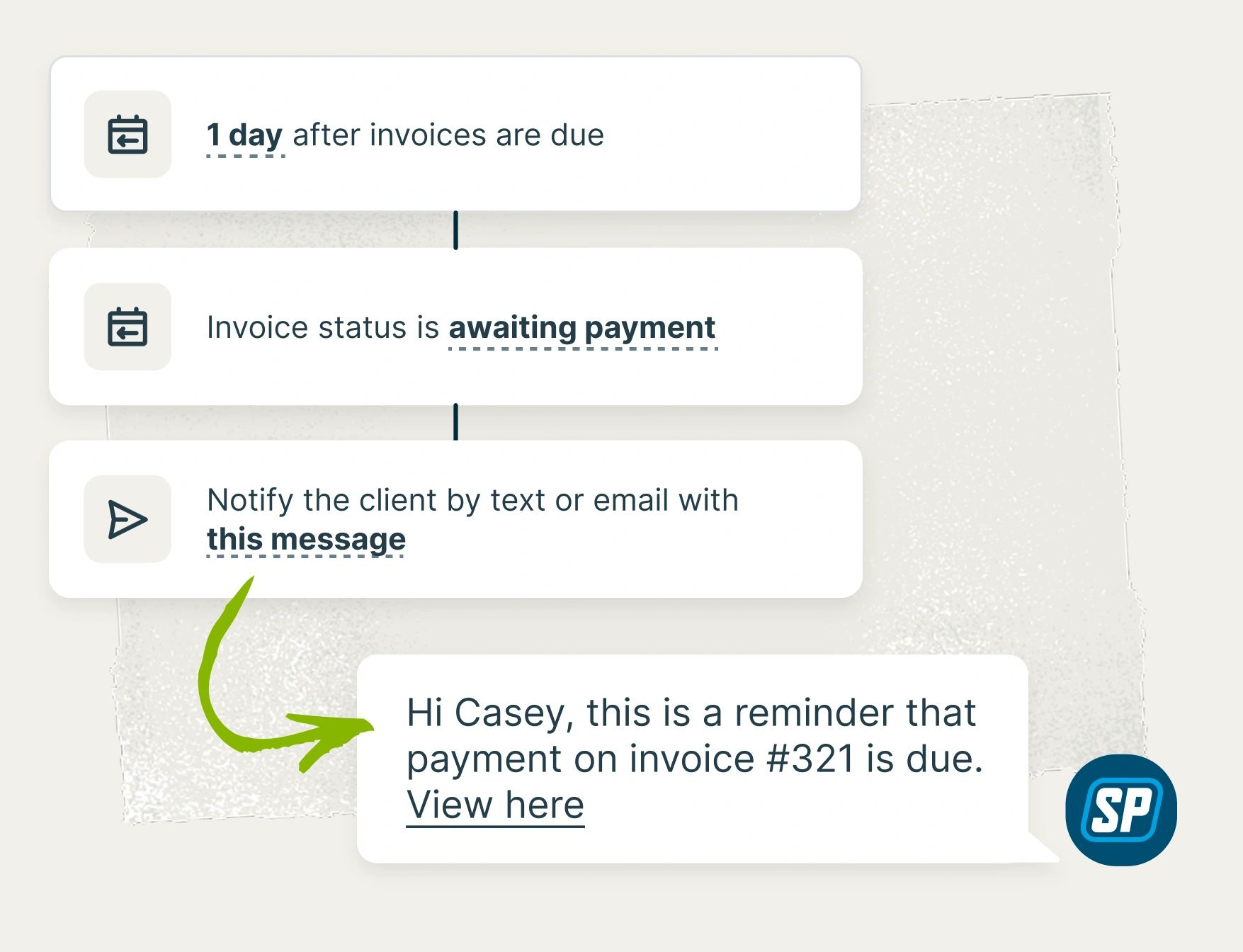

8. Send payment reminders

Send payment reminders before a due date has passed to get ahead of late payments. For longer billing cycles, like net 30, it’s good practice to send a reminder 1-3 days before the invoice due date if a client hasn’t paid you. It gives them a chance to pay their invoice before any fees or penalties apply and saves you from chasing down late payments.

The easiest way to do this is to use payment processing software like Jobber to automate payment reminders on unpaid invoices before they’re even due.

9. Try different contact methods

If all else fails and you’re trying to collect money from a customer who is unresponsive, it may be time to try another way of getting in touch.

For example, if you’ve only been reaching out via email, your messages could be going straight to their junk folder or you might have the wrong address.

Instead, try giving them a call, sending a text or letter, or leaving a notice at their home.

If the custome is another business, try contacting someone else from the company. It’s possible that your contact is on vacation, switched jobs, or their department doesn’t handle payments.

10. Use software to upgrade your payment collection process

Using payment processing tools is one of the most effective ways to collect payments from customers. The most popular platforms for home service providers are Stripe, Square, and Jobber, but each one works differently.

For example:

- Stripe works well for online payment processing and complex billing models. Like if you need to customize your payment processing software to suit your business’s unique requirements.

- Square is known for a variety of hardware options that offer in-person payment processing. While it also supports online payment methods, it’s more popular for those with physical offices or storefronts.

- Jobber blends online and in-person payment processing methods designed for home service businesses.

With Jobber’s payment processing software, you can:

- Accept onsite payments with Tap to Pay on your mobile device

- Process online payments on your website or through invoice payment links

- Set up recurring payments for ongoing work

- Receive ACH bank transfers

- Collect tips from happy clients for a job well done

- Manage booking, scheduling, quoting, invoicing, and getting jobs in one place.

Choosing the right tools can save you time, money, and stress, so you can focus on building your business instead of chasing payments.

What do you do if a customer doesn’t pay you?

51% of businesses receive payments after their due dates, which means you’ll probably have to deal with an outstanding invoice at some point.

Before you do, make a late payment escalation process so you have a roadmap to follow by using these steps:

1. Send a friendly payment reminder

1-3 days after a payment is due, send a follow-up to your client to let them know their invoice is overdue. Include the invoice number, amount due, and simple instructions for how to pay.

For example:

Hi [customer name], your payment for invoice [#] was due on [payment due date]. As per our payment terms, a late fee of [$0] will be applied if payment in full is not received by [date]. Please make payment as soon as possible through [payment methods] to avoid additional penalties. If you have any questions, please give us a call at [phone number]. Thank you!

2. Follow up

If the customer still hasn’t paid you 7-14 days after the due date, it’s time to send another reminder. This time, you should be firmer and include a reference to your payment terms outlining any upcoming late fees or interest charges.

For example:

Hi [customer name], your payment for invoice [#] was due on [payment due date]. As per our payment terms, a late fee of [$0] will be applied if payment in full is not received by [date]. Please make payment as soon as possible through [payment methods] to avoid additional penalties. If you have any questions, please give us a call at [phone number]. Thank you!

3. Apply late penalties

Since different jurisdictions have different rules and regulations for late fees, when you can apply a late fee depends on the state you live in. Some states require grace periods, like 5-30 days, while others don’t, and some limit how much you can charge.

Once a customer passes the necessary grace period, you can proceed with charging a late fee as either a percentage of the bill due or a flat rate.

A standard late fee is 1-2% of the total, or $10 per month.

Once it’s applied, send the client another message to let them know and outline when the next fee will be charged if they don’t pay.

For example:

Hi [customer name]. Your invoice [#] was due on [date]. As it is now [number of days] past due, a late fee of [$0] has been applied. The total due is [$0]. If it is not paid by [date], you will be charged an additional [$0].

4. Consider a collection agency

After 90 days have passed without payment, you may want to consider hiring a collection agency. This is a third-party company that will take on the responsibility of tracking down the client and collecting payment. In exchange, they take a percentage of the amount recovered.

5. Take it to small claims court

Your last resort is to take the client to small claims court. Most states require the invoice to be below a certain limit to qualify, which ranges from $2500-$15,000.

Before filing, make sure you have:

- Copies of your quote, contract, invoices, and any payment reminders you sent

- Documentation of any communication with the client about the payment or service

- Records of any late fees or penalties that have been applied

It’s important to remember that taking a customer to small claims court doesn’t guarantee payment. Weigh all your options and use other methods before moving forward, and ensure you have a paper trail to support your claim.