QuickBooks vs FreshBooks: Key Differences, Pros, and Cons (2024)

The main difference between QuickBooks and FreshBooks is that FreshBooks is accounting software best for project-based freelancers and solopreneurs that just need basic accounting. QuickBooks is a more advanced solution that can handle small, midsize, and large-business accounting and reporting.

Only QuickBooks Online syncs with Jobber to connect your accounting with your field service quoting, invoicing, and payments software without double entry.

QuickBooks and FreshBooks are both popular accounting solutions for businesses across many industries. They offer tools to improve your cash flow management, accounts receivable, accounts payable, financial reporting, and more.

How are QuickBooks and FreshBooks different?

QuickBooks offers advanced bank matching, invoicing, and inventory management tools to help you manage more complex accounting tasks. Compared to FreshBooks, QuickBooks has:

- More features that automate your accounting, like tax deduction calculations and custom rules for categorizing transactions

- More plans and versions that fit a wider variety of business types and levels of accounting experience

- More recognition—since QuickBooks has been around for longer, you’re more likely to find an accountant who has experience with QuickBooks

FreshBooks has a smaller, more basic set of accounting features, but it’s a favorite among freelance creators and self-employed consultants. FreshBooks is unique for having:

- Built-in time tracking features on all plans that helps project-based businesses track billable hours

- A more intuitive, beginner-friendly layout and design

- Lower monthly subscription fees

Here are a few other ways QuickBooks and FreshBooks are different:

| QuickBooks | FreshBooks | |

| Ideal business types | Small business teams that want to automate their accounting and bookkeeping | Freelancers, solopreneurs, and micro-businesses that don’t need to expand their company size |

| Unique features | • Set custom bank matching rules • Send unlimited invoices on all plans • Advanced inventory management features (including low stock alerts and pricing rule settings) • Syncs with Jobber (field service management software) | • Online portal where clients can view and pay invoices • Time tracking available on all plans |

| Number of users supported | 1–25 | 1, plus a monthly cost for additional users |

| Available add-ons | • Track time on a project from anywhere (QuickBooks Time) • Pay your team, track hours, and offer employee benefits (QuickBooks Payroll) • Get live online support from expert bookkeepers (QuickBooks Live Bookkeeping) | • Automatically charge client credit cards (Advanced Payments) • Run payroll (PaymentEvolution Payroll) |

| Third-party app integrations | 750+ | 100+ |

| Customer support | All plans include 24/7 live chat support. Phone support is available at select times Monday through Sunday. | All plans include phone support from Monday to Friday and email support. No live support from real agents. |

Compare key features of QuickBooks and FreshBooks

QuickBooks and FreshBooks can help you accomplish many of the same accounting and bookkeeping tasks, with some notable differences in how their features work.

Here are the differences between QuickBooks and FreshBooks’s key features:

Bank reconciliation

📚 Reconciliation: the process of comparing your business records with your bank records to ensure they match.

| QuickBooks | FreshBooks |

| • Bank reconciliation available on all plans • Global search function to find transactions • Set up your own bank matching rules | • See transactions side-by-side with your bank feed • Mark a transaction as a Transfer, Owner’s Equity, or Expense Refund |

Both QuickBooks and FreshBooks help you reconcile your transactions by detecting matches between your bank statement and your accounting software. You can quickly edit transactions from one page and even edit transactions in bulk.

Still, FreshBooks and QuickBooks have different approaches to the bank reconciliation process:

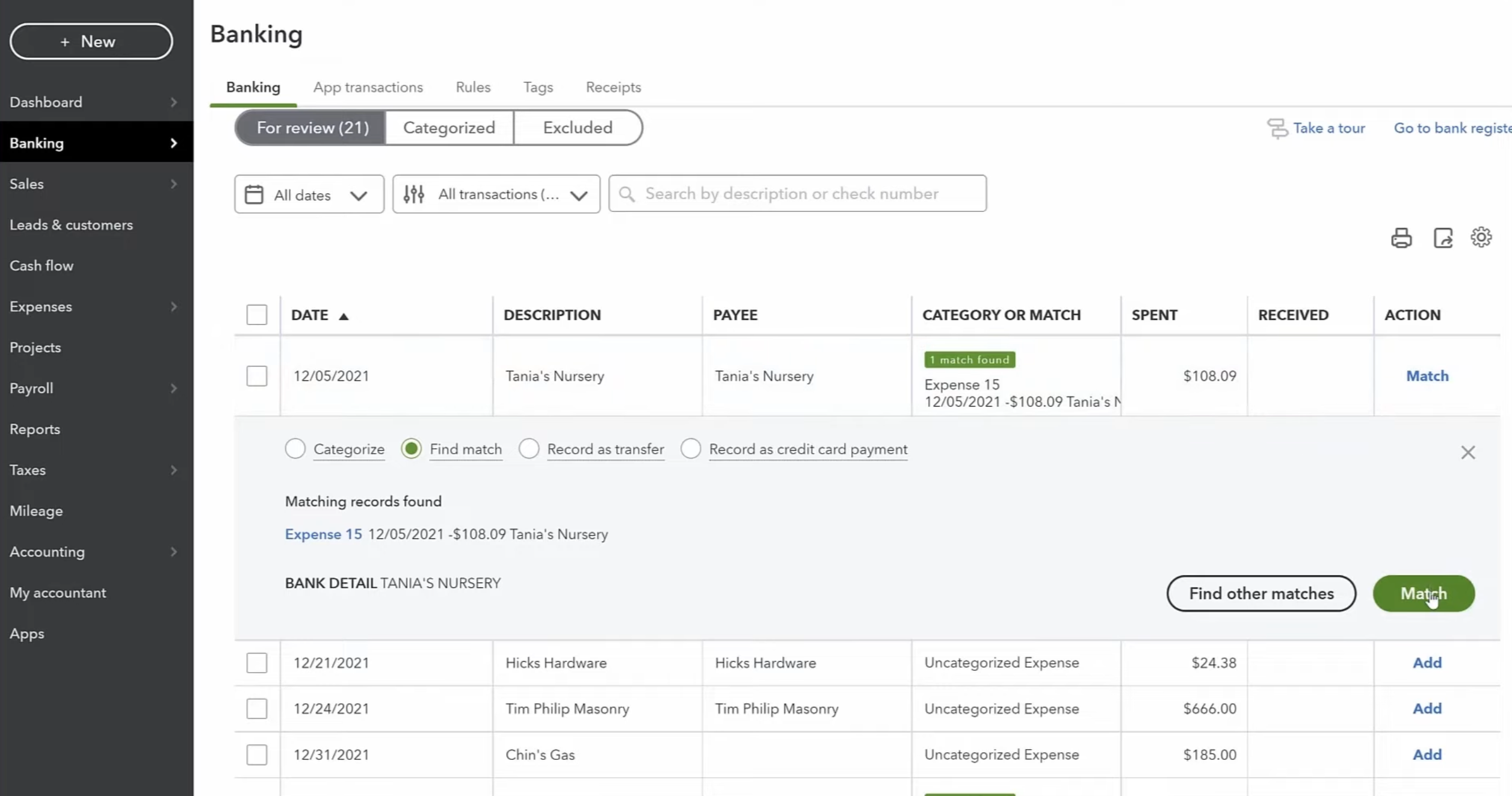

QuickBooks: Bank Feeds in QuickBooks helps you categorize your transactions before you officially reconcile them with your bank account. Use Bank Feeds by connecting your business bank account to QuickBooks Online.

In Bank Feeds, all transactions you’ve entered into QuickBooks appear in a single, clean table. QuickBooks tells you when it finds a matching bank transaction, and lets you set custom rules that automatically file transactions under the categories you’ve set.

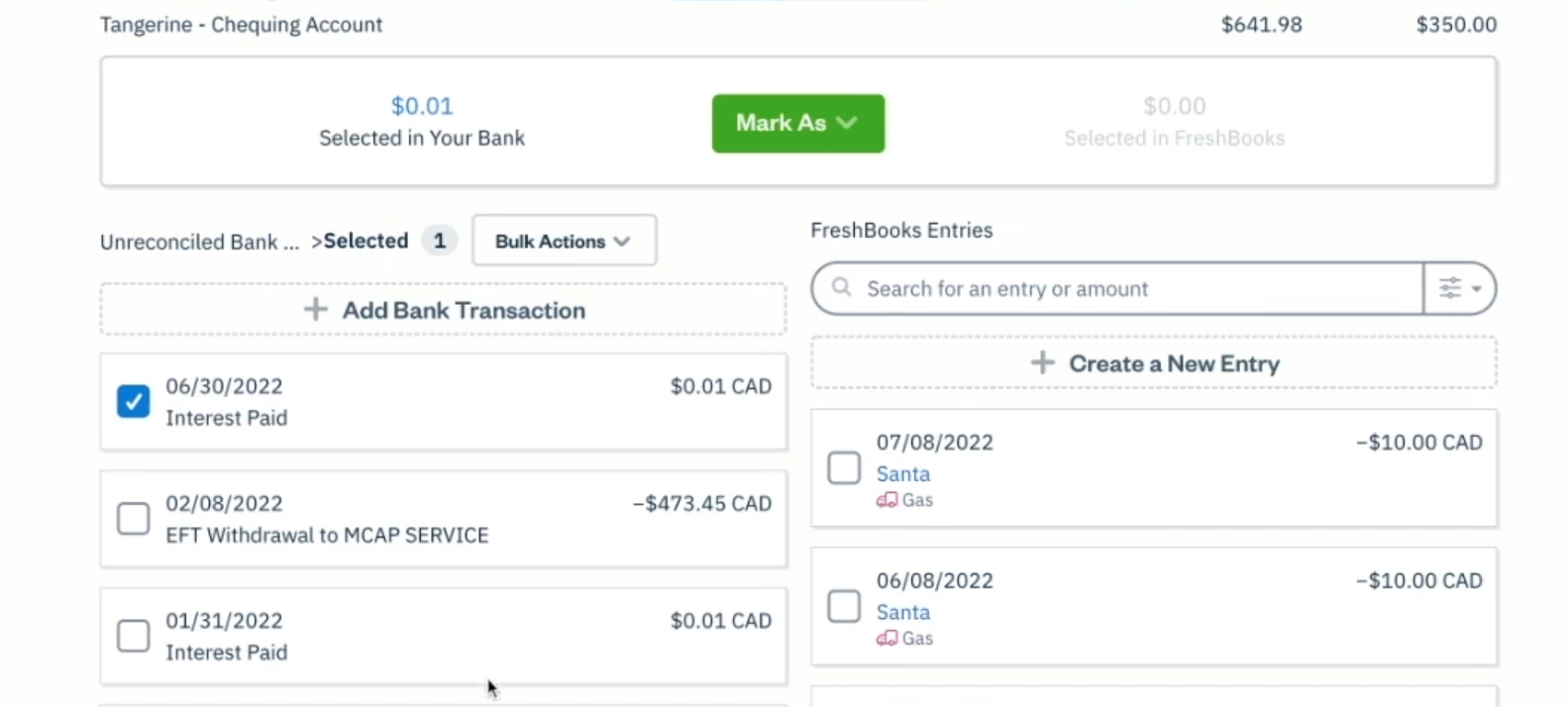

FreshBooks: Transaction matching, categorization, and bank reconciliation all happen in one place. All transactions you’ve entered in FreshBooks appear side-by-side with your bank feed.

It’s also easy to tell FreshBooks if an unreconciled bank transaction doesn’t require an accompanying FreshBooks entry to match it to. This is useful when handling bill payments, owner’s equity, or expense refunds.

However, the lack of a global search function makes it harder to find transactions.

Invoicing

| QuickBooks | FreshBooks |

| • Send unlimited invoices on all plans • Choose what details customer see on their invoice • Track when a customer has viewed their invoice | • Generate an invoice from logged work hours • Let clients view and pay invoices through an online portal |

QuickBooks and FreshBooks both help you send customized invoices and offer dashboards that show your outstanding invoices and balances. Both apps let you send recurring invoices and set automated invoice reminders.

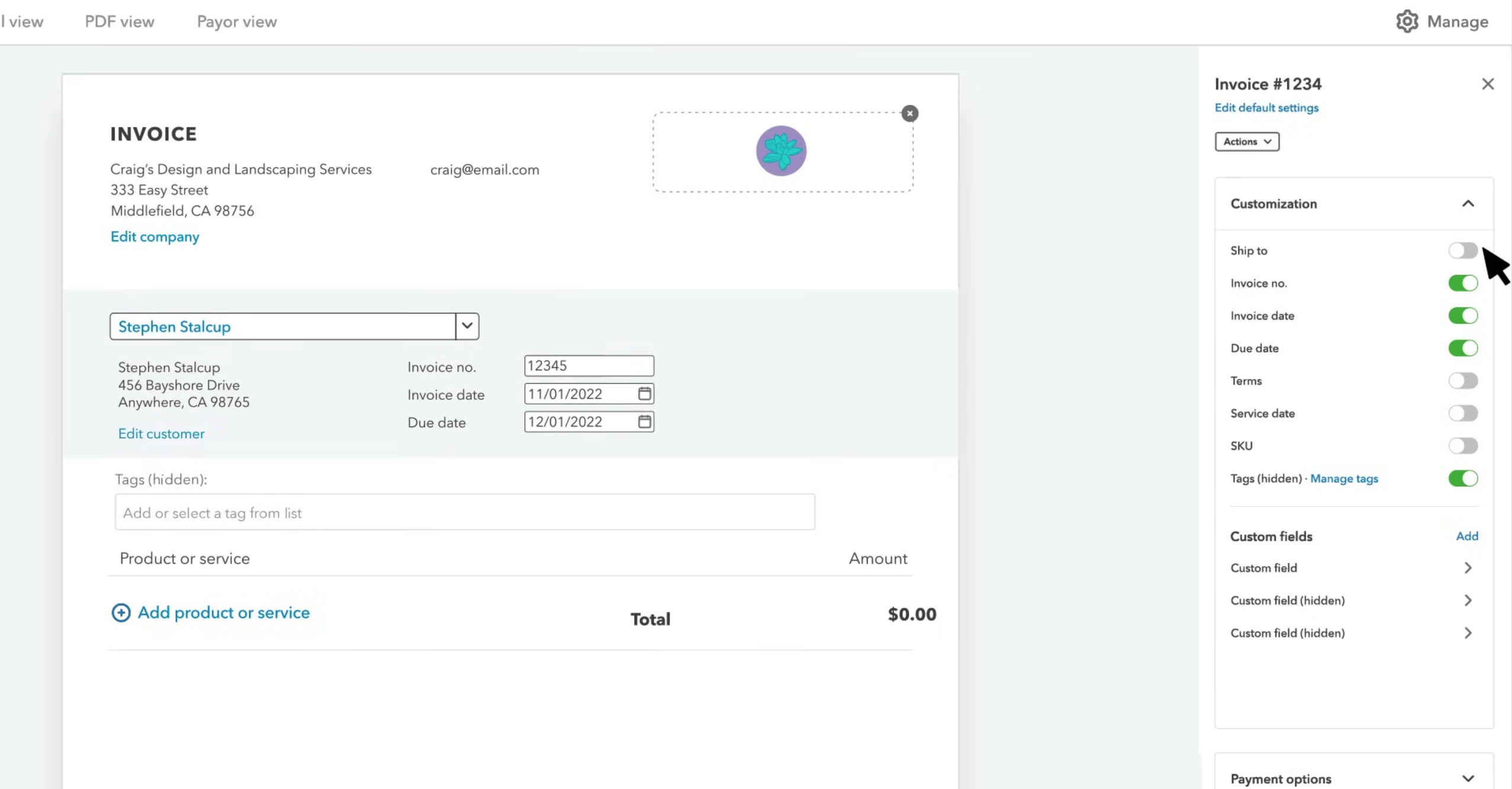

QuickBooks: QuickBooks lets you choose the details that customers see on your invoice. You can include or exclude a ship-to address, invoice number, payment terms, a SKU number for inventory, and custom tags.

QuickBooks will also show you when a customer has reviewed an invoice.

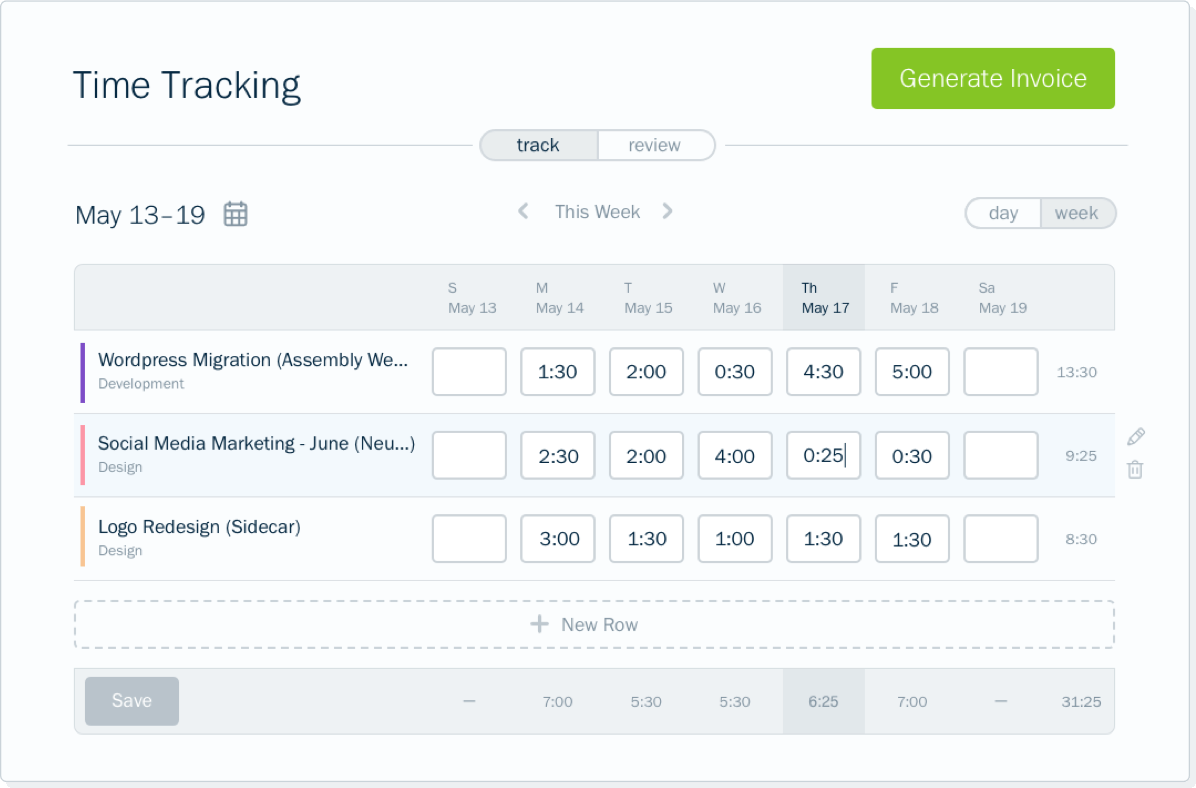

FreshBooks: Because it offers time tracking on all its plans, FreshBooks is ideal for invoicing billable project work. Once you’ve tracked the time spent on a client or project, FreshBooks lets you instantly generate and send an invoice that includes those worked hours.

Your clients can view and pay their FreshBooks invoices through an online portal.

| Need a client portal that lets your customers book work, too? Explore the Jobber client hub

Inventory management

| QuickBooks | FreshBooks |

| • Add and track inventory • Add reorder points • Create purchase orders • Set pricing rules to customize product rates • Run inventory reports to find best-sellers and highest-cost products | • Add and track inventory |

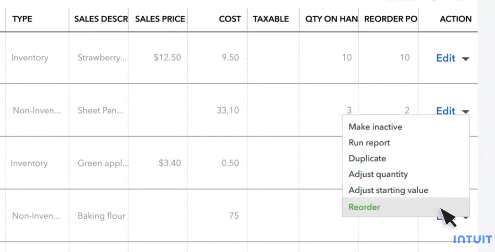

Inventory tracking is available in QuickBooks and FreshBooks. Both tools will tell you when a product is almost or completely out of stock, but only QuickBooks helps you reorder stock and analyze your inventory sales.

QuickBooks: Purchasing and reordering inventory is built into QuickBooks. Click on the item that’s running low in stock to generate a purchase order instantly.

You can also set reorder points for specific items that tell QuickBooks when to alert you of low stock. Then, run reports on which items sell the best and which items are costing you the most.

FreshBooks: FreshBooks can handle basic inventory tracking. When you enter a new item in the system, you can check off “Track Inventory” to tell FreshBooks it should decrease your stock when you invoice for that item.

That’s the limit of FreshBooks’s inventory management capabilities.

Compare pricing plans

While QuickBooks offers several products at varying price points (like QuickBooks Self Employed and QuickBooks Enterprise), QuickBooks Online is its most popular product—and it has four pricing tiers just like FreshBooks.

Here are all QuickBooks Online pricing plans and the features they offer:

- QuickBooks Online EasyStart offers basic accounting tools for a single user. It’s the best place to start for solopreneurs, freelancers, or sole bookkeepers.

- QuickBooks Online Essentials supports up to three users, includes accounts payable tools, and offers multi-currency support. It also integrates with QuickBooks Time, a time tracking add-on.

- QuickBooks Online Plus supports up to five users and lets you track project profitability, inventory, and multiple business locations.

- QuickBooks Online Advanced supports up to 25 users and offers robust reporting and customization. Advanced also lets you build automated accounting workflows to save time, send invoices in batches, and sync your Excel spreadsheets.

All QuickBooks plans allow you to invite up to two accountants, send unlimited invoices, and store as many billable clients as you want.

FreshBooks has less expensive pricing tiers than QuickBooks, but charges an additional fee for every user you add.

These are FreshBooks’s pricing plans:

- Lite is FreshBooks’s best plan for freelancers just getting started or solopreneurs with very few customers. You can send unlimited invoices to up to five clients, track expenses, and get paid online.

- Plus has all of Lite’s features, but with a 50-client limit, automatic expense tracking, and more advanced reporting.

- Premium removes the client invoicing limit and lets you run accounts payable, customize email templates, and track project profitability.

- Select is a fully customizable plan that gives you access to special support in the setup and onboarding process.

READ MORE: Compare QuickBooks Online with QuickBooks Desktop

Only Quickbooks Online connects with Jobber to keep your service business organized

QuickBooks Online pairs with Jobber—a highly rated field service management solution—to keep your customer, invoice, and payment information accurate without any double entry.

By quickly and accurately syncing your important business information from Jobber to QuickBooks Online, you’ll cut hours of manual work every week and get back valuable time.

When you connect Jobber with QuickBooks Online, you can:

- Easily import existing clients, products, and services from QuickBooks Online to ensure both are accurate from day one

- Control when and how important information is synced from Jobber to QuickBooks Online moving forward

- Automatically sync your clients, products and services, timesheets, invoices, payments, refunds, tips, and payouts from Jobber to QuickBooks Online

- Approve timesheets in Jobber and sync them to QuickBooks Online to use for payroll

- Automatically reconcile payouts for payments and tips collected through online payments in Jobber

See what customers say about Jobber

Automate admin work. Save time.

With home service software, you can take on more work without hiring more staff.