10 Business Metrics to Start Tracking Now

Everyone knows that dreaded feeling.

Scheduling their yearly call with their accountant to find out: did we win or did we lose?

All the while knowing that whatever the financial statement says, it doesn’t relate to the money in their bank account, right now—today.

Besides that, the meeting is July 5th, and the company year-end was Dec 31st, so the new business year is already half over.

That’s when it hits them:

Everything they will discuss on July 5th will be a looking backward conversation. Very little on their financial statement will give them insight on what to do next. Remember, there are only six months left in this year!

It’s not the accountants fault. The issue lies in one simple premise: that at the bottom of the financial statement is one value we are told is everything—profit.

But here’s the thing: You can’t chase profit without understanding what makes you profitable. And you won’t find that on the bottom of a financial statement.

That’s where business metrics, also known as KPIs (Key Performance Indicators) come in.

Understanding Business Metrics and KPIs

KPIs are measures that indicate the performance of your company. Each one represents an area of your business that drives cash flow, which in turn, influences profitability.

Instead of answering “did we win or did we lose?”, KPIs help you understand “how are we performing, and how can do better?”

When identified, targeted, and measured, KPIs can help you understand the real health of your business, and give you the control to influence it.

A classic way to think of KPIs is through the lens of sports. Take hockey, for example.

Every team counts their wins and losses at the end of the season, just as you count up your profits and expenses.

But those wins are merely outcomes. They’re the results of other factors, such as number of shots on goal, number of goals by a player, and goals against average.

Each of these factors—or KPIs—determines the effectiveness and performance of the team.

The team can’t will themselves to simply ‘win more,’ just as you can’t will yourself to ‘be more profitable.’ But you can understand your KPIs and start to improve them.

That’s how you win.

There’s a lot of noise about which KPIs to focus on. And tracking irrelevant ones can waste your time and distract you from what matters.

We’ve got you.

We’ve narrowed down the top 10 most important business metrics that actually matter for home service businesses and how to measure them.

Bookmark this page and come back often. These are quite literally the keys to your business’ success.

Here are the top 10 Business metrics for service businesses, ranked by importance

#1. Cost of Goods Sold (COGS)

What is it? COGS is the total cost to deliver a job, including materials and outside labor. (Outside labor means contractors or hourly employees who are not on your payroll.)

The best way to determine if something is a COGS is to ask yourself: would I have this cost if I did not have this job?

If it’s a fixed cost, like rent, insurance, or salaries, then it’s not COGS.

Why is it important? COGS directly impacts your bottom-line profit. If your COGS go up, your profit goes down and vice versa.

Tracking COGS is also important to understand where your profit is going. If you’re taking on bigger jobs and bigger jobs, but you don’t watch your COGS, you may find yourself working harder and taking in more money, but keeping less of it.

How do I calculate it? Material costs + outside contractor costs + any other costs specific to delivering this job (special permits, etc.)

Track COGS on a per-job basis using a spreadsheet or your bookkeeping software. Learn more about COGS and operating expenses here.

Want to improve this metric? Watch How to Reap the Rewards of High Profit Jobs

#2. Operating Margin (OM)

What is it? Operating margin is the percentage of money you keep on each job, after paying for salaries and raw materials.

Why is it important? Your operating margin tells you if each job is likely to be profitable and helps you understand your company’s performance. If you have a consistently low OM, that means you’re not keeping enough profit for each dollar you make.

For example, if you do a $1,000,000 job, but only keep $10,000, that’s a 1% OM— not great. If your OM is 45%, however, you’d keep $450,000. Or for an $80,000 job, you would expect to keep $36,000. Much better.

How do I calculate it? (Revenue – COGS – wages) / Revenue x 100%

Want to improve this metric? Read Profit Margins: a Complete Guide for Small Businesses

A Note on Benchmarking and KPIs:

When it comes to measuring the KPIs on this list, forget about comparing yourself to others. It’s also not about finding your averages and labelling them as ‘good’ or ‘bad’.

All that matters is measuring and understanding your personal averages, so you can strive to improve them over time.

#3. Average Invoice Price (AIP)

What is it? AIP is the average of all invoice amounts received over a defined period of time

Why is it important? Your AIP is a signal of how well you’re selling.

An AIP that’s trending down is a sign of trouble. An AIP that’s consistent over time could mean an opportunity for you to sell more to your clients. Targeting and raising AIP isn’t just upselling, it’s up-serving. It indicates how well a business is truly understanding their customer needs and how they address them

The six most dreaded words we can hear from a current customer are ‘I didn’t know you did that’ (as in, I bought it from someone else!).

Money left on the table here is the number one reason businesses don’t succeed.

How do I calculate it? Dollar value of all invoices in a given period / total number of invoices

The first thing everyone says when asked about their AIP is “oh, I can’t tell you, it’s all over the place. I have jobs that are $10,000 and I have ones that are $500.” Every business is the same in this regard, but what matters is this: You can’t influence your AIP if you don’t know what it is.

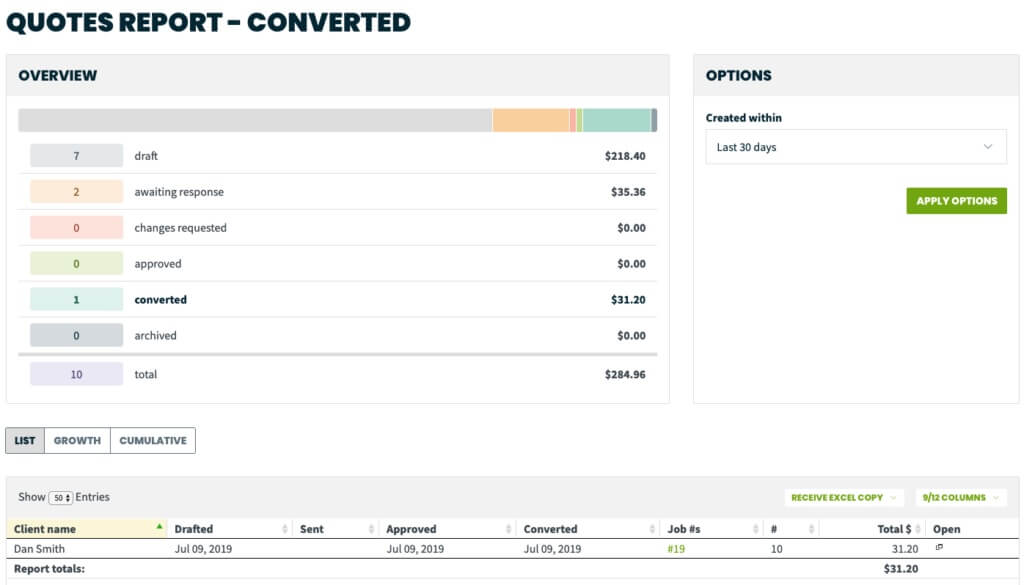

If you use invoicing software, simply export your invoice report for a given time period, as in the image below. If you don’t use software, you’ll have to find all of your old invoices and count them up manually.

Want to improve this metric? Read 5 Ways to Get More Revenue from Existing Clients

#4. Average Number of Transactions (Customer Retention)

What is it? The Average Number of Transactions is a measure of how many times your average customer books or ‘transacts’ with you. It’s a way to measure repeat business and customer retention.

Why is it important? Many experts and authors have emphasized the simple sentiment that ‘Repeat Business = Profit.’

Repeat customers are 50% more likely to try new services and spend 31% more than new customers over time. Since you’ve already spent on marketing efforts to acquire them, it’s worth doing everything in your power to keep them.

As a KPI, your Average Number of Transactions has a huge impact on your profitability. Once you know yours, you can invest in customer retention strategies, including customer education, service packages, and internal database marketing to increase it.

How do I calculate it? Total # of invoices in a given time period / Total # of unique customers

To find this in Jobber, make sure you have added ‘client name’ as a column to your invoice report and count the number of unique client names.

Want to improve this metric? Try these Customer Retention Strategies

#5. Break Even Sales Revenue

What is it? The break-even point for a service business is when your costs and your revenue become equal. Once break even revenue is achieved, all subsequent revenue earned during that time frame is primarily profit.

Why is it important? Responsible business owners know their break even revenue per year, per month, per week, and per day in some cases. The break even number signals the proverbial ‘black horse’ overtaking the ‘red horse’ — that is, the moment we go from simply covering costs to actually being profitable.

Once you know your break even and your average invoice price, you can calculate how many new jobs you’ll need to be profitable. You can then focus your marketing efforts on achieving that.

How do I calculate it? (Fixed overhead expenses + Payroll) / Gross Profit Margin %

Note that breakeven needs to be adjusted often. If you grow your team or increase your overheads, you need to recalculate your break even.

#6. Quote-to-Job Conversion Rate

What is it? Your conversion rate (CR) is the percentage of quotes you win over the total number of quotes you send. It’s ultimately a measure of how well you bid and sell jobs.

Why is it important? If your CR is low (less than 50%) it could mean you’re pricing too high or you’re unable to convey the value of your services. If your CR is high (over 75%), it could mean you’re pricing too low.

Either way, if you don’t know your CR, you’re leaving money on the table.

How do I calculate it? Total quotes sent / Total quotes converted x 100%

This is a KPI everyone thinks they know, but never actually measures. Our rule is: if you have to guess, your conversion is half of what you think it is.

To find this metric in Jobber, open your quotes converted report. If you aren’t using a client manager (CRM) like Jobber, you can manually count your total quotes and sales.

Want to improve this metric? Try these Pricing Strategies for Service Businesses

#7. New Leads Per Month

What is it? Let’s start with what leads are not. They’re not likes, views, comments, shares, or follows. To truly count somebody as a new lead, you need the ability to follow-up with them. In other words, you need their contact information.

A new lead is someone who has taken some action that provides you with the opportunity to do business with them. A phone call, email, online request, or social media message are all actions that create leads.

A contractor who takes a call while driving and has a great conversation with someone about a new project, but hangs up with the other person saying ‘well, sounds great, I’ll get back to you’, didn’t really get a new lead because they don’t have the prospect’s info.

Likewise, if you go networking and hand out 30 business cards, you actually left with zero leads. Whereas if you traded four business cards with others, you would have earned four new leads that you can enter into your CRM and begin to market to.

Why is it important? If you’re not getting new leads, you’re not getting new business.

Even if you’re not actively trying to grow your business (which you should be), tracking new leads can help you determine the effectiveness of your marketing efforts, or help you understand what kind of demographics you’re attracting.

How do I calculate it? Sum of all new leads within a given time period.

Instead of tracking manually, use a CRM or lead management software to track new leads. Use lead labels to track where leads came from, what part of the city they’re in, and what services they are booking. Here’s what that looks like in Jobber:

#8. Amount of New Online Reviews

What is it? A count of how many online reviews our company has received in a given time frame.

Online reviews only count when they are published by a customer on a review platform (Google, Facebook, Angie’s List, Yelp, etc). A testimonial sent via email and then added to your website is still beneficial, but doesn’t count for this KPI.

Why is it important? Customers and prospects rely heavily on online reviews to book new work. If you don’t have new reviews, or you’re only getting negative ones, it’s a strong signal that your business isn’t a good choice to work with.

As a KPI, tracking your online reviews lets you keep tabs on customer satisfaction and the likelihood of booking new work. While you should be looking at both the number of reviews and the average rating, start by just tracking the number of reviews and go from there.

How do I calculate it? Sum of all online reviews across your chosen platforms.

If you use review management software, pull a new review report at least once a month. If you don’t use software, identify the top 3-5 platforms where customers go to find you and start tracking your new reviews in a spreadsheet.

Want to improve this metric? Follow these steps to get more reviews.

#9. Percent of Billable Payroll Hours

What is it? A measure of how many hours you pay for labor are actually spent on billable work for the customer.

Some companies will monitor this KPI including all staff hours worked, regardless of position in the company, while others will only include ‘labor’ hours for technicians or crews in the field.

Note that if 100% of your work is performed by contractors, we may choose not to watch this KPI as it’s usually understood that 100% of their time is ‘billable’ time.

Why is it important? In the service industry, time and labor are directly related to money. Watching this metric can lead to some tough questions about your efficiency, work ethic, billing methods, and even technology processes.

The good news is, tracking this metric can uncover inefficiencies that are costing you money, such as inefficient routing or time spent doing administrative tasks that could be automated.

How do I calculate it? Total billable hours / Total paid hours worked

Want to improve this metric? Try time tracking software

#10. Total Discounts Given Over a Period of Time

What is it? A two-pronged measure telling us both: how many times did we discount over a given time period, and what is the total dollar amount in discounts we gave up during that time frame?

Why is it important? In our experience, discounting is the number one killer of small businesses, period. It’s a slow and seductive disease; we can become obsessed and even euphoric with ‘winning’ job after job, while all the time slowly losing the war.

For example, consider if your company has a service for $100, of which $80 is expense, and $20 is clear profit. Now, say we offer 10% off (which most business owners will do in a heartbeat). At the surface we may think well 10% is nothing, but here’s the catch: your profit didn’t go down 10%, your profit was cut in half!

Hopefully this is a KPI we only need to monitor for a while in our business, because the intention is that after having it in our face for a while we eventually get ourselves to zero or next to zero discounts being offered. But until then, we measure it and we watch it, and if it makes us sick to our stomach, good. Better to be informed and have a chance to make changes than to die in the ignorance of discounting realities.

How do I calculate it? Sum of all invoices with discounts OR sum of all discounted revenue.

To find this KPI, you need to start by creating accurate invoices that show the full price and the discount you’ve offered. If you’re verbally changing pricing on the fly without properly indicating it on the invoice, you won’t be able to measure the impact— not to mention that’s a pretty cavalier approach to both your success and record keeping compliance.

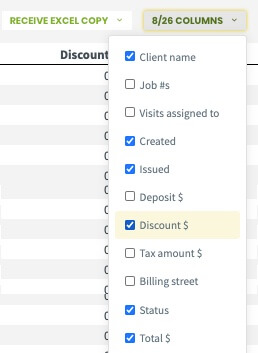

You can track discount amounts automatically by going to your invoice report and adding “discount $” from the drop-down column.

Want to improve this metric? Watch How to Track Discounts the Right Way in Jobber

Okay, take a breath. We realize that this is a big list—maybe overwhelmingly so. But as we’ve hopefully have stressed here, the first step to mastering your business metrics is simply to know what they are, and why they matter.

Now that you’re clear on the ‘what,’ we hope you can turn your attention to the ‘how.’

Meaning, how am I going to influence these KPI’s and when will I expect to see changes?

About the Author: Kevin Simpson is an award-winning Certified Executive Business Coach with over 25 years of real-world coaching results. He’s owned several small to mid-size companies, and understands the key drivers to growing businesses and giving owners complete clarity on how to make their businesses profitable. Kevin is a raving fan of Jobber and the impact it has with the companies that rely on it. Learn more about his practice at Action Edge.